The Japanese yen (FXY) is the one major currency that has been notably weaker than the U.S. dollar for most of the past month. USD/JPY peaked in December, 2016, but it looks like the sell-off bottomed out in April.

Source: FreeStockCharts.com

This yen weakness has been particularly evident against strong currencies, like the euro (FXE), where April formed a sharp and abrupt trough.

Source: FreeStockCharts.com

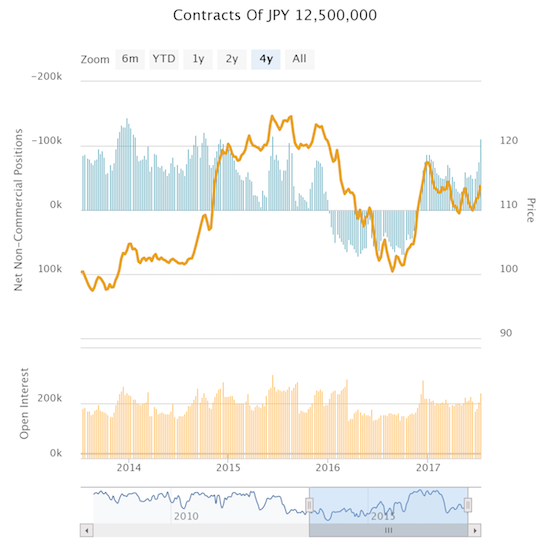

Speculators have finally seen enough. Since speculators last flipped from net bulls to net bears in December, April turned into the trough of bearish sentiment. Speculators re-accumulated net shorts slowly but surely until the latest week. Speculators rushed for shorts to the tune of -112,125 contracts, a level last seen in June, 2015. Net short contracts were -75,036 the previous week.

Source: Oanda’s CFTC’s Commitments of Traders

This extended weakness caught me by surprise, but it makes sense give the Bank of Japan’s willingness to remain quite dovish even as other major central banks begin to turn their backs on further monetary easing. The Bank of Japan delivered the market a stern reminder that it is not ready for higher bond yields when on July 7th, the BoJ announced “it would buy an unlimited number of 10-year JGBs at a yield of 0.110 percent, and it increased the size of its regular buying of five- to 10-year JGBs by 50 billion yen ($439.96 million) to 500 billion yen…” (see CNBC). The 30-year and 40-year JGBs had hit yields not seen since since February of 2016. Even the 10-year had crept up to a 5-month high. Clearly, the market was trying to anticipate a (marginally) more hawkish BoJ given Japan’s relatively good economic performance and the global environment of tightening central banks.

I have been more focused on reasons to get long the yen, especially as a hedge against bullish sentiment in financial markets. However, the BoJ’s action convinced me to stand down a bit and focus on more shorting opportunities. While there is likely not a lot more room for speculators to get even more bearish on the yen, I also do not expect them to retreat anytime soon. For example, the yen looks too good as a funding currency for carry trades. From a technical standpoint, I love shorting the yen against the euro the most. It helps that I remain a euro-bull.

Be careful out there!

Full disclosure: net long the Japanese yen, long the euro

The carry trade stuff is getting s bit overdone. Aud up another 1.6% today on no real news. I couldn’t resist shorting Aud.usd @ .793. Will take a loss if it keeps going. Have SL at .805, but I think it will fall back a bit at least in the short term. Too far, too fast.

Well that was a fast low return, high risk scalp on audusd. Managed to make a profit but will avoid the mean reversion plays on this sort of thing. There’s not much profit in getting it right. Although the daily move is now 3 standard deviations out and well above the top of the daily Bollinger band. Maybe I will look to short again another 100pips from here.

Actually, it is low risk, low reward type scalp here. Low reward, but what the heck, sometimes it’s nice just to hit it just right. I mean when it is up 1.7% today, 1.5% yesterday and 8% for the last 10 days, there’s not a huge risk, depending on sizing

Any guesses Duru on whether Audusd gets to 0.8 Or 0.8160 ? The latter would

Correlates to 1.17 on the euro.

The AUD spike higher is a true head scratcher, but I saw the conditions for shorting disappear based on rate expectations and speculative positioning. The latest move is presumably in response to RBA minutes. I noted commentary that the RBA explicitly set the neutral rate at 3.5%. That’s pretty surprising that they think it’s that high AND that they went on the record with their assessment! I have a to-do to go back and read the minutes for myself.

The move looks over-extended. I imagine shorts will come out in force at 0.8. But the big problem is the USD’s on-going weakness. Better the short AUD against another currency like euro or even the pound.

Addendum: GBP/AUD is well below lower-Bollinger Band but it also cracked through 200DMA support over the last several trading days. So I would prefer buying EUR/AUD even though it looks like 50DMA is turning into resistance and a top. In other words, short AUD only for a quick swing trade!

Here is a nugget that could explain some of the speculative rise: record Chinese steel production. Also, look at the way RIO and BHP have spiked alongside the Aussie. I may need to write about all this!

COLUMN-Record Chinese steel output rests on record speculative interest: Andy Home

Another month, another Chinese steel production record. China’s giant steel sector churned out 72.78 million tonnes of the stuff in June. That was equivalent to annualised production of 891 million tonnes.

Yes, I saw that 5% rise in iron ore price. Still I think the move in aud is overdone. Perhaps it isn’t though because the spec longs are not even at an extreme yet. Probably safer to short NZD. Too bad I hadn’t thought to go long aud.nzd. The underlying driver seems to be the idea the RBA will be next to go after BOC move.