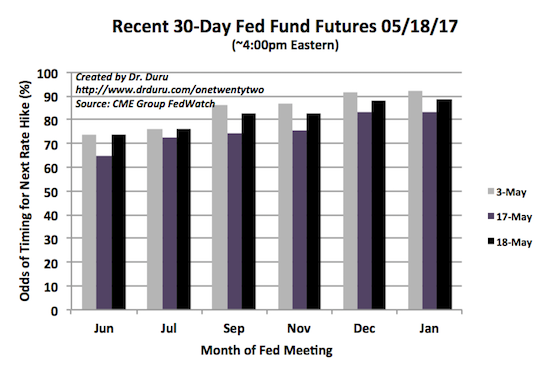

I am surprised Fed futures traders still firmly expect a rate hike from the U.S. Federal Reserve in June.

Source: CME FedWatch Tool

After the stock market sell-off in the wake of more Trump turmoil, the market pegged the odds of a June rate hike from the U.S. Federal Reserve at 64.6%. Above 50% means that more likely than not, the rate hike will occur in June. The odds bounced right back in the next day of trading to 73.8%. This resilience in June expectations is surprising given the viciousness of the selling and the accompanying drop in long-term interest rates. The drop in rates caused the iShares 20+ Year Treasury Bond ETF (TLT) to gap up to a 1.4% gain on the day.

Source: FreeStockCharts.com

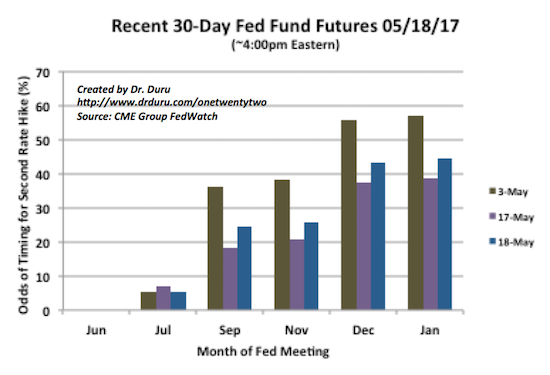

Despite all the accompanying drama on the day, TLT did not make a new high for 2017. While the turmoil was not enough to punch interest rates past the trading range or unseat June expectations, the turmoil DID take two rate hikes for 2017 clear off the table. After the Fed’s pronouncement on monetary policy on May 3rd, the odds of two rate hikes by December stood at 55.8%. After the day of Trump turmoil, those odds tumbled all the way to 37.6%. Futures traders recovered some of their confidence on the next day, but the odds are still well below 50%.

Source: CME FedWatch Tool

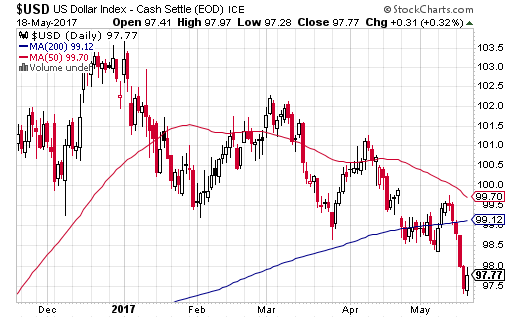

It is likely the plunge in odds for two rate hikes helped grease the skids for the U.S. dollar (DXY0) and confirmed a 200DMA breakdown. The dollar bounced back along with the odds of rate hikes.

Source: StockCharts.com (FreeStockCharts had an error at the time of writing)

Gold has benefited where the U.S. dollar has lost. The latest rally swept the SPDR Gold Trust (GLD) past resistance at its 50 and 200-day moving averages (DMAs). The gap up was impressive as it completed a full recovery from the Fed-inspired loss in the first part of May. The next day’s pullback stopped at 50DMA support. Since GLD is working on a nice rally of higher highs and higher lows from the December, 2016 Fed rate hike, this pivot around important DMAs takes on extra significance.

Source: FreeStockCharts.com

Even as the stock market begins to stabilize from the initial shock of an actual reaction to Trump’s increasing turmoil, I strongly suspect that rate-sensitive plays will continue to exhibit a lot of movement.

Be careful out there!

Full disclosure: net short the U.S. dollar, long GLD shares and call options

Great analysis Duru. I too was somewhat late in appreciating the implications of the first French election and wasn’t short dollar/ long euro equities until shortly before the second French election. However, still caught a ride on euro to 1.11 but exited too early.

With the short dollar trade, in the short term, I think it may be in for a correction. If the fed are not scaling back expectations of rate hike in June to below 50% at this late stage then I suspect they will take the opportunity to hike in June. Overall, I think the dollar is fairly valued at this point in time, but if they do hike in June then short rates will increase in probability from current situation to 100% and with no rate expectation for the rest of the year priced in there is room for the dollar to rally into the rate hike and perhaps for a short time after. With that I am exiting short dollar positions except for a small long CAD position which I still like due to the positioning. I think holding dollar shorts through a fed hike could be uncomfortable, like holding a gold long after the second French election recently. I am looking to short dollar again after rate hike and hopefully further rate hikes for the rest of the year start getting priced in again. However if they don’t hike in June, I will miss out.

I will stay short the dollar going into the June meeting. I fully expect a hike and then a softening of stance. If I am correct, the dollar *should* tank sharply and quickly. It will be hard to jump into the middle of that. And by the time the dust settles, the entry may loo like poor risk/reward. Oh man – if the Fed doesn’t hike in June when the market expects a hike?!?! Look out below for the dollar (and short financials like crazy as an aside).

Having said that, I have yet to stay fixed in a short dollar position. I have bought dips or faded rallies (depending on the pair), and then taken profits when the market delivers them up. I have tended to hold the carry trade pairs like USD/MXN and USD/TRY a little longer in order to collect interest payments while I wait on the next unfolding move.

Good counterpoint Duru and you may well be correct. I think if they are going to pass on June, they would release something by now disavowing the market of the current FEd funds futures pricing.

Given that, I think the dollar has fallen a bit already and it maybe too much to expect much fall with a rate hike. Is anyone waiting to buy or sell dollars until after the fed hike. Arguably, if there are more like me waiting to sell after the hike then you will be right. But if there are more like you selling before the hike, then you will be wrong ! That’s the perversity of markets and short term positioning.

“Perversity” is indeed a great term. 🙂

How about I compromise and just say I will follow the technicals on this one. As long as the dollar index is below its 200DMA, I will fade rallies. I will not chase downward as this descent has been halting and grinding enough to demonstrate that patience pays off…

I am coming over to your way of thinking and if the majority are waiting to sell the dollar after the rate hike like me then it will fall into a hole beforehand. I guess as you say, we will have to keep our eyes open and see what happens !

However, my target has been met with CAD so I am out for now, particularly with oil towards the upper end of the range. Interestingly, some Aussie banks got downgraded today and the Sydney housing market has some early signs of slowing. Whether this is just a pause or the beginning of the oft expecting housing mudslide in the Aust/Canada/NZ will be interesting.

As I type, USD/CAD is teetering on 50DMA support. If it breaks, I will have to jump back in and play to a test of 200DMA support. Sometimes hard to say how much of CAD is oil and how much other factors.

No impact on the Aussie as yet…