(This is an excerpt from an article I originally published on Seeking Alpha on February 27, 2017. Click here to read the entire piece.)

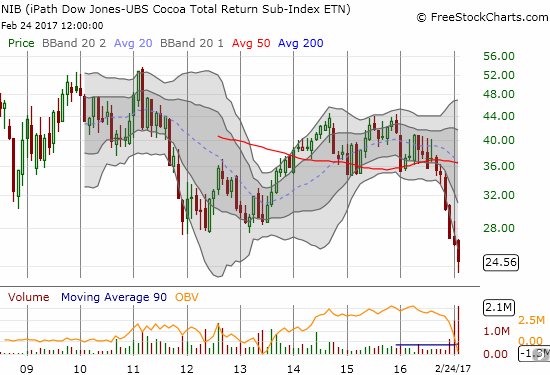

In late August, 2016, I got ready to buy back into the iPath Bloomberg Cocoa SubTR ETN (NIB) as a part of my strategy to trade its price range at that time. {snip} In fact, the downtrend on NIB is so steep that its 20DMA defines downward trending resistance now.

Source: FreeStockCharts.com

I treated this extended decline as a unique buying opportunity to accumulate NIB at much cheaper prices than was possible before (in spite of the common wisdom that commodities tend to trend for long stretches of time!). I think of the secular rise in demand for chocolate as an enduring support for cocoa prices and current weaknesses are temporary. {snip}

While I have kicked myself for failing to execute on the early selling opportunity, I know I have good company in assuming that cocoa would manage to return to its previous trading range if not better. Exporters in the Ivory Coast, the world’s largest cocoa producer, have defaulted on contracts after making bad futures bets on higher prices. The declining price of cocoa took its toll on these shippers. {snip}

The defaults have also taken their toll on cocoa farmers in the Ivory Coast. {snip}

Back when cocoa prices were at a peak in June, 2016, there were no signs of the coming collapse. {snip}

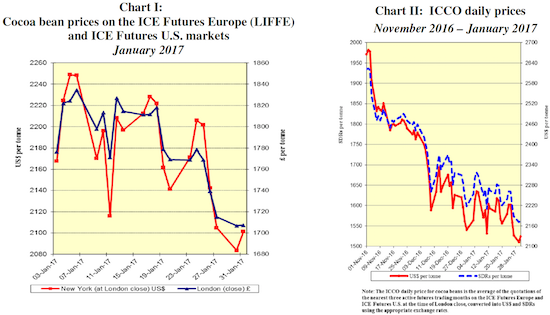

Prices recovered quickly in the weeks following Brexit in U.S. dollars, pounds, and SDRs (Special Drawing Rights). However, in the second half of July, the sell-off resumed. {snip}

Source: The International Cocoa Organization (ICCO)

The current demand picture is quite mixed. {snip}

The current weakness should self-correct as cheaper prices restoke demand in 2017. Eventually, some kind of weather calamity or production failure will hinder supply; if not this year, then the next. So, my long-term bullishness on cocoa remains the same. As a result, I am sticking to the longer-term strategy of buying NIB when it is cheap (and sell when it gets high). The main difference now is that NIB is selling at or near bargain basement levels I thought would never come, especially after cocoa was a top-performing commodity not too long ago.

Be careful out there!

Full disclosure: long NIB

(This is an excerpt from an article I originally published on Seeking Alpha on February 27, 2017. Click here to read the entire piece.)