(This is an excerpt from an article I originally published on Seeking Alpha on December 27, 2016. Click here to read the entire piece.)

The SPDR Gold Shares (GLD) has increased 6.3% since December 15, 2015. The U.S. Federal Reserve hiked its interest rate the next day and made its second hike for this cycle two weeks ago. This gain against the rate hike grain SHOULD be the headline for GLD and a relatively positive one for gold’s resilience going forward…{snip} Instead, the main headline for now is that GLD collapsed mightily from a 28-month high set over the summer. {snip}

Source: FreeStockCharts.com

The writing was on the wall for GLD starting with the summer high, but I first focused on finding a spot for playing a bounce in the middle of the sell-off. {snip}

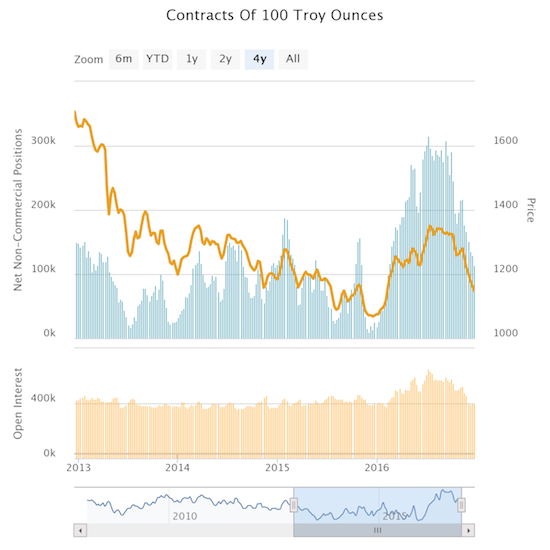

Source: CFTC’s Commitments of Traders

The chart above suggests that gold will not regain former momentum until speculators get back on board.

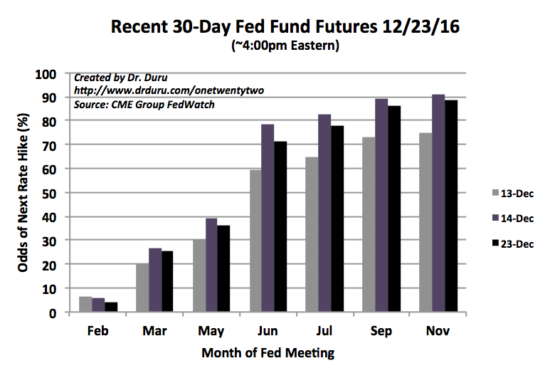

In the meantime, the prospects for the next Fed rate hike are murky. {snip}

Source: CME Group FedWatch

Regardless, a LOT can and will happen in the next six months; yet, the market’s moves in the past two weeks imply a high level of certainty for what is coming in this time. The biggest wildcard out there sits with President-elect Trump’s actual policies. {snip}

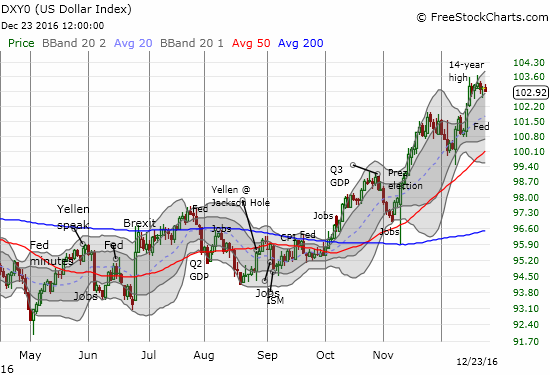

Source: FreeStockCharts.com

{snip}

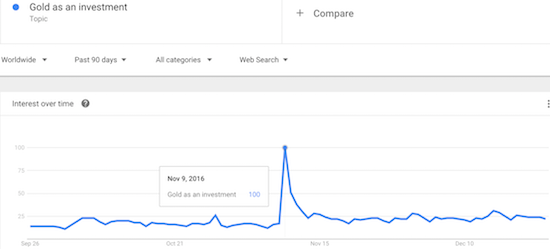

As one last signal, I checked in on Google Trends. {snip}

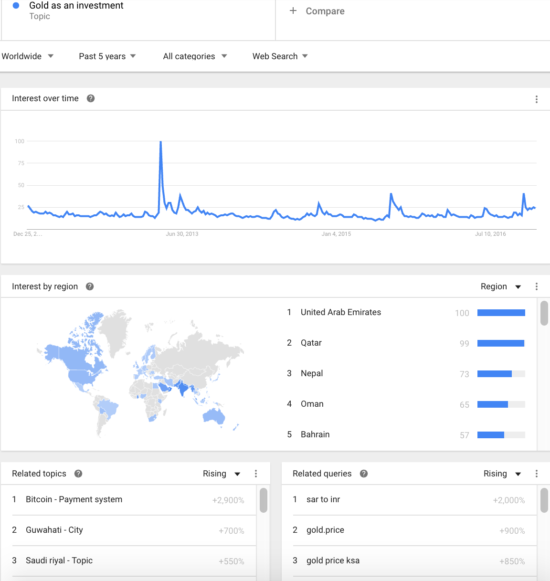

In recent posts on GLD, I noted the challenge of “term pollution” from searches using “buy gold” that do not refer to the precious metal. I am now actively tweaking my methodology to accommodate this pollution. I may have stumbled upon a satisfactory substitute with topics in Google Trends. The charts below show the trends in the topic “gold as an investment.”

Source: Google Trends

The latest spike in interest in gold as an investment corresponds directly with the fallout from the election of Donald Trump. {snip} If anything, the interest in gold related to the rupee’s manipulation has likely prevented gold from falling further faster that it already has. I am assuming that holders of Indian rupees are looking to gold as a potential alternative to shield themselves from further government machinations with the currency.

{snip} Given the context, fundamental and technical, the sentiment spike confirms that gold has likely topped out for the time-being. In other words, given a spike in interest was unable to turn the tide, I am assuming the path of least resistance will firmly remain downward. GLD’s low from 2015 is back in play.

A look back at the last major spike in interest in gold further supports the need for me to make this adjustment in my interpretation of the sentiment signal. {snip}

On the surface, the April, 2013 episode revealed a weakness in the usefulness of the contrary nature of the sentiment signal. However, the important context I dismissed too easily during that episode was that GLD suffered a major technical breakdown. {snip} Overall, that episode for GLD served as a reminder of my experience with major technical breakdowns: they tend to generate follow-through before a complete reversal and end to the breakdown.

Source: StockCharts.com

{snip}

Be careful out there!

Full disclosure: long GLD

(This is an excerpt from an article I originally published on Seeking Alpha on December 27, 2016. Click here to read the entire piece.)