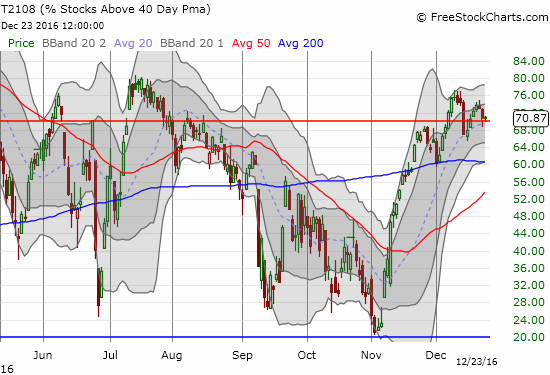

(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 70.9%

T2107 Status: 64.6%

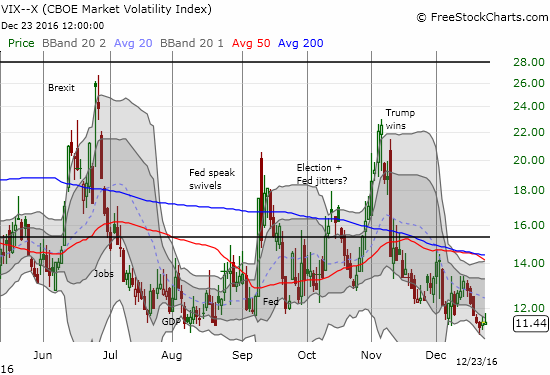

VIX Status: 11.4

General (Short-term) Trading Call: neutral

Active T2108 periods: Day #213 over 20%, Day #33 over 30%, Day #32 over 40%, Day #30 over 50%, Day #24 over 60%, Day #6 over 70% (overbought)

Commentary

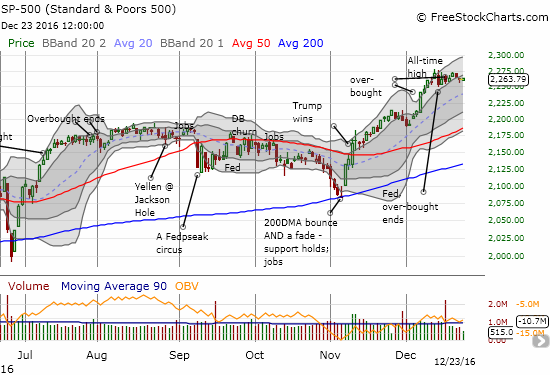

The market’s enthusiasm has notably waned going into Christmas. A consolidation pattern has emerged for the S&P 500 (SPY) that further tempers my expectations for the seasonal “Santa Claus rally.”

The first half of December, defined by me as the first 10 trading days, delivered a gain of 2.5%. This gain was reduced by the post-Fed selling that dropped T2108 from overbought status. The Santa Claus rally, defined by me as the remaining trading days of December, have so far failed to recover the modest post-Fed loss while producing a meager 0.5% gain. I analyzed the numbers for the Santa Claus rally two years ago and found a strong tendency for the second half of December to deliver a gain for the S&P 500 no matter how the first half performs. So, I continue to expect a benign trading environment going into the end of the year.

The slow deterioration in T2108, the percentage of stocks trading above their 40-day moving averages (DMAs), belies this otherwise benign consolidation period. In my last T2108 Update, I described how my favorite indicator made a feeble return to overbought status. Its struggles over the past two trading days to cling onto that overbought status seem to validate my assessment.

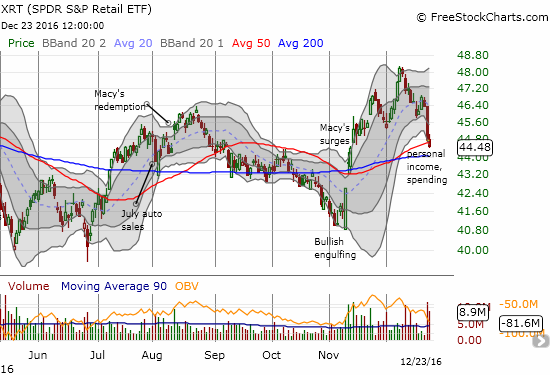

Given this struggle, my eyes are more tuned for signs that confirm market weakness even as I maintain a neutral short-term trading stance. Top of my “worry list” are SPDR S&P Retail ETF (XRT) and the Australian dollar (FXA) trading versus the Japanese yen (FXY).

XRT sold off dramatically this week in the wake of data on personal incomes and spending. The selling cracked 50DMA support and continued a trend of near persistent selling since the S&P 500 convincingly broke out on December 7th. XRT now looks ready to finish reversing all its post-election gains during the biggest retail period of the year.

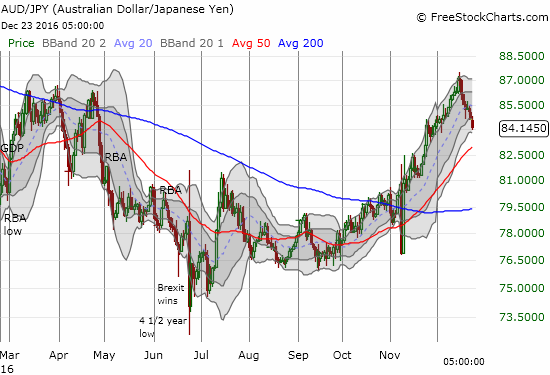

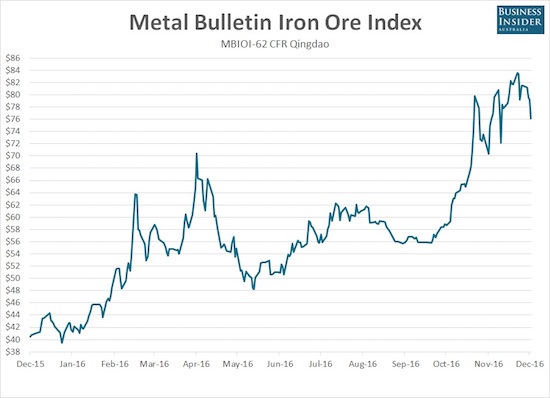

The Australian dollar notably weakened after the Federal Reserve hiked interest rates. Sellers have turned on the commodity-driven currency enough to send AUD/JPY hurtling downward from its last high – that high just happened to finally bring AUD/JPY back to even for the year. Support at the 50DMA is now in play. I am guessing a significant pullback, perhaps even a crash, is around the corner for iron ore, Australia’s most important export.

Source: Business Insider

As a reminder, I think of AUD/JPY as a close proxy for the market’s attitude toward risk. So, the strong rally since the election served as convincing confirmation of the market’s renewed bullish fervor. The sell-off since the Fed’s rate hike now serves as convincing confirmation that this fervor has lost steam. AUD/JPY will play prominently in my next decision to flip the short-term trading bias off its neutral stance.

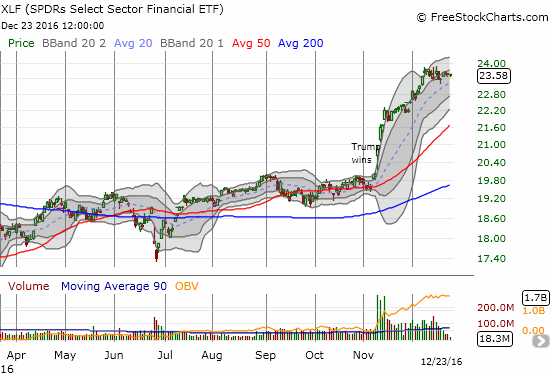

I continue to monitor Financial Select Sector SPDR ETF (XLF) as well of course. Like the S&P 500, XLF has gone into consolidation mode since the Fed. I cannot imagine getting bullish during this overbought period without XLF breaking out of this consolidation to the upside.

I conclude with an overdue requiem for my Telsa (TSLA) versus Solar City (SCTY) pairs trade. I first proposed this trade in early September. After mixed results, I dug in my heels with positions expiring this month. This position turned out to be one of the worst pairs trades I have put in place in a very long time. Both sides, the TSLA call spread and the SCTY put spread, expired completely worthless whereas I am usually able to salvage one side of the trade when things do not work out as hoped. TSLA shareholders approved the merger with SCTY with nary a protest. The whole event became anti-climactic.

TSLA is up 12.6% for the month and is up a whopping 17.6% from a retest of the last lows. This impressive move carved out a W-bottom that is on the edge of confirmation. I fully plan to play TSLA in the coming days or weeks based on its behavior around its critical 200DMA.

— – —

FOLLOW Dr. Duru’s commentary on financial markets via email, StockTwits, Twitter, and even Instagram!

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

The charts above are the my LATEST updates independent of the date of this given T2108 post. For my latest T2108 post click here.

Related links:

The T2108 Resource Page

Be careful out there!

Full disclosure: mixed positions on the U.S. dollar, long SDS, short AUD/JPY