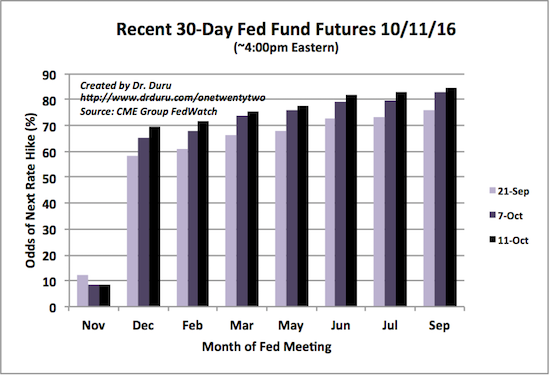

The creep toward a December rate hike continues. The 30-Day Fed Fund Futures now show a 69.5% chance of a rate hike in December by the U.S. Federal Reserve. This is a full 11.1 percentage points above the odds in the wake of the Fed’s September 21st pronouncement on monetary policy.

Source: CME FedWatch

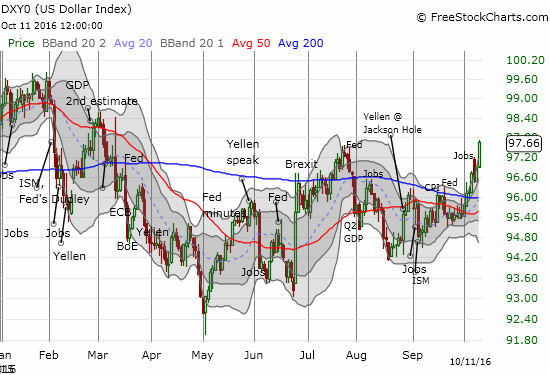

The U.S. dollar is one beneficiary of this pressure to hike rates in two months. The U.S. dollar index (DXY0) printed another big up day. This move to a fresh 7-month high appears to confirm the recent 200-day moving average (DMA) breakout.

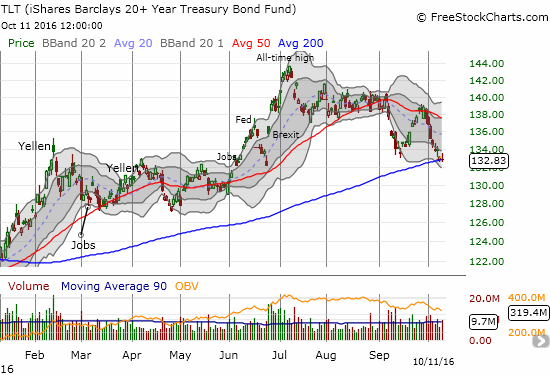

Consistent with the dollar’s rise and the likelihood of a December rate hike, bond yields are creeping higher. The iShares 20+ Year Treasury Bond (TLT) is now testing support at its 200DMA.

TLT’s test is doubly important. Not only is the 2016 uptrend defined by the 200DMA at stake, but also the post-Brexit run-up is completely over. Similarly, the pre-Brexit breakout is over. TLT has pulled off a double roundtrip. While I am already long a December call spread on TLT as a hedge, I am VERY tempted here to add to this position (perhaps with longer expiration dates): every time I think bonds have topped out, some economic news or some Fed event turns things upside down all over again.

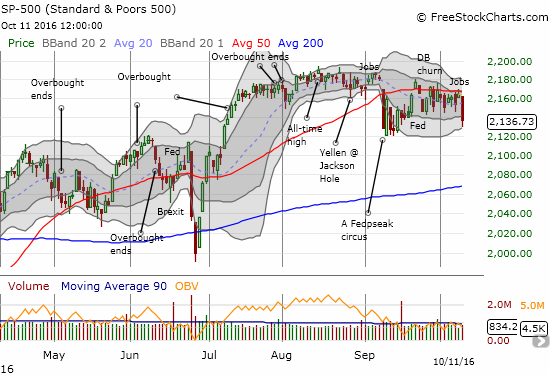

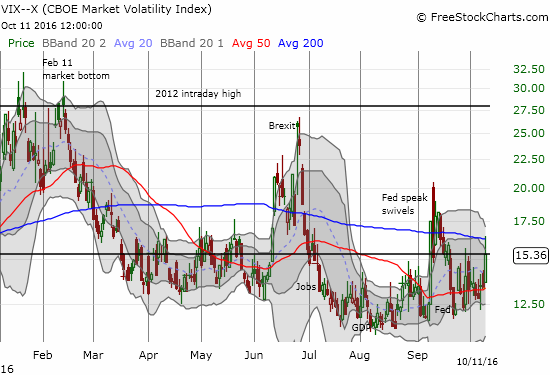

Perhaps the biggest issue is whether the stock market can weather all this pressure. So far, conditions are looking incrementally more tenuous. The S&P 500 (SPY) sold off with a 1.2% loss in yet another failure at 50DMA resistance. (I was once again able to execute my strategy of flipping put options on SPY, but I severely under-estimated the potential downside on the day!) The volatility index, the VIX, jumped as high as 23% before closing right at the all-important 15.35 pivot.

Source for charts: FreeStockCharts.com

Be careful out there!

Full disclosure: net long the U.S. dollar, long TLT call spread, long UVXY shares and short UVXY call option, long SDS