(This is an excerpt from an article I originally published on Seeking Alpha on October 8, 2016. Click here to read the entire piece.)

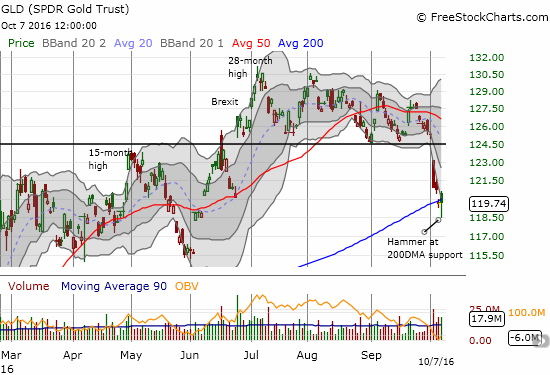

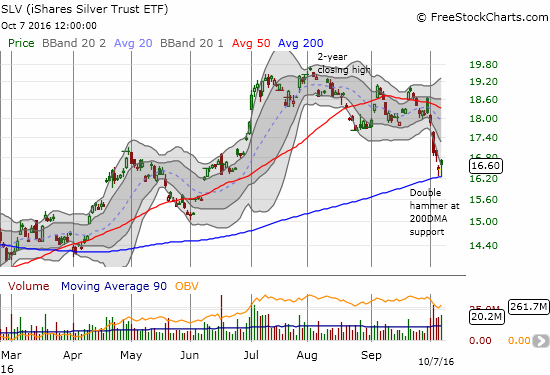

On October 5th, I noted how SPDR Gold Shares (GLD) and iShares Silver Trust (SLV) both completed post-Brexit roundtrips as rumors of a eurozone tapering of QE triggered a fresh wave of selling in the precious metals. I used this event as another opportunity to examine the case for a (short-term?) topping in GLD and SLV. The trading action immediately before and after the U.S. jobs report for September, 2016 provides an opportunity to trade on a relief rally as GLD and SLV make a bid for a bottom.

{snip}

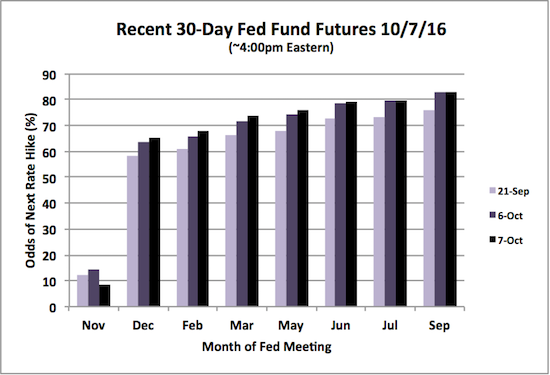

Source: CME Group FedWatch

Per previous history, the Fed futures is closing on near certainty for a December rate hike. Futures sat around 80% the day before the Fed’s December, 2015 rate hike and were in the high 60s a month prior. In other words, I do not think higher levels from here really communicate much more certainty in the minds and actions of traders. {snip}

{snip}

{snip}

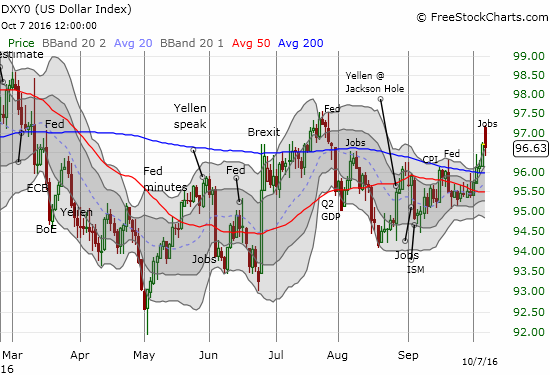

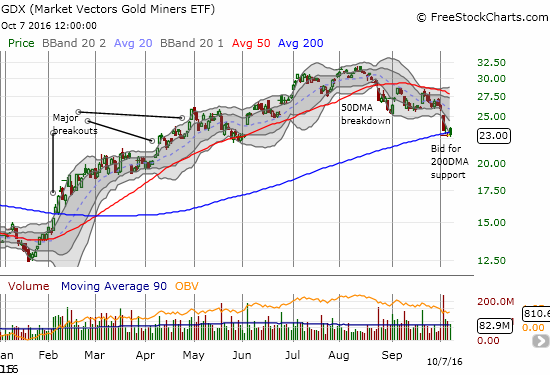

Source for charts: FreeStockCharts.com

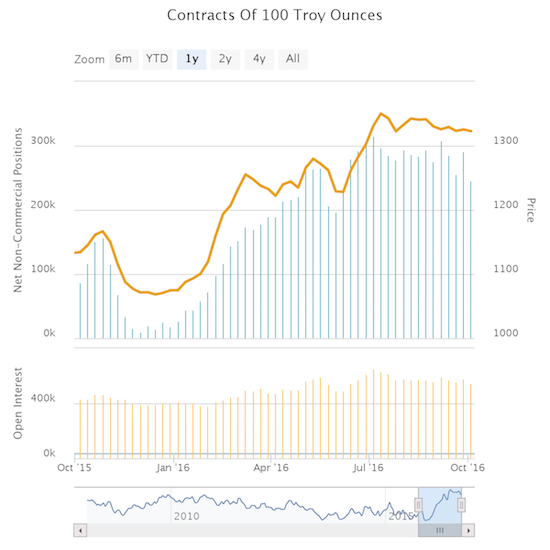

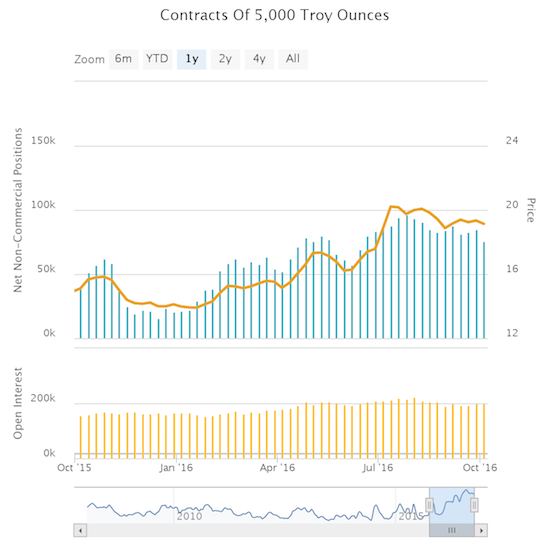

I am a little more comfortable trading around my core long positions in GLD and SLV because speculators have cooled off a bit from recent highs in speculative positions. {snip}

Source: Oanda’s CFTC Commitments of Traders

{snip}

Going forward I do not expect a rally in GLD or SLV to top recent highs. The most likely catalyst that could get both over the hump may, ironically enough, be an actual rate hike from the Fed. {snip}

Be careful out there!

Full disclosure: long GLD, SLV (shares and call options)

(This is an excerpt from an article I originally published on Seeking Alpha on October 8, 2016. Click here to read the entire piece.)