Mario Draghi ALMOST got the language of infinite liquidity right this time around…

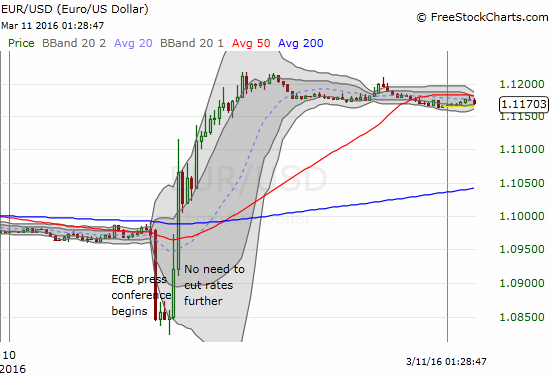

The euro (FXE) approached the European Central Bank’s (ECB) March 10th press conference on monetary policy with high expectations. Even after getting burned in December’s Draghi Drubbing, the currency market “felt” prepared to accept that ECB President Draghi had learned the lessons well. Initially, Draghi seemed well prepared for the performance. The ECB delivered beyond market expectations with a “bazooka” full of measures to pump even more liquidity into the eurozone. These measures even include PAYING banks to make loans. The impact was immediate as the euro sank hard and fast.

Yet, Draghi found a new way to deliver an unpleasant surprise (depending on your side of the market of course). The well-orchestrated monetary easing turned into a Draghi Drubbing redux. Instead of keeping the market honest and on guard for more anti-deflation medicine, Draghi suggested that the ECB is done with rate cuts (emphasis mine):

“How low can we go? Let me say that rates will stay low, very low, for a long period of time, and well past the horizon of our purchases. From today’s perspective, and taking into account the support of our measures to growth and inflation, we don’t anticipate that it will be necessary to reduce rates further. Of course, new facts can change the situation and the outlook. Let me also add that the experience we’ve had with negative rates, in our case at least, has been very positive, in easing financing conditions, and in the transmission of these better financing conditions to the real economy. We are also aware that – by the way, here there are different views about whether negative rates have affected, or how they affect, the profitability of the banking system. We can discuss this later.”

Without even a hint of irony or humor, Draghi continued to ponder the positivism of negative rates. Draghi concluded that a lower bound on rates does indeed exist:

“But let me tell you: does it mean that any negative rate will be positive? Does it mean that we can go as negative as we want without having any consequences on the banking system? The answer is no. And you probably know that we’ve discussed for some time the possibility of having a tiering system, so an exemption system for this operation, and in the end the Governing Council decided not to, exactly for the purpose of not signalling that we can go as low as we want on this.”

The result was serious whiplash in currency markets.

In a flash, I went from celebration to patient self-confidence to astonishment. There is almost nothing worse than going from being right (a large gain) to executing poorly (a not as large loss) before processing that a change in market sentiment and momentum required a change in strategy. I heard the comments on rates and saw the euro start to turn, but I failed to act because I did not want to get churned out of my position. Fortunately, I DID take profits on other bets before Draghi sent the euro soaring. Otherwise, the losses could have been worse. Instead of paring back my short on EUR/USD, I decided instead to scale into “risk-on” trades which were getting sold as the euro climbed.

(At the time of writing, I have already taken profits on one of those new trades: the ol’ reliable short GBP/AUD. I will likely soon close out a fresh short on EUR/TRY).

The stock market was a bit confused about how to interpret the day’s events – the S&P 500 (SPY) first rallied at the open, sold off to last week’s low, and the rallied into the close to end the day essentially flat.

Where equities were confused, gold was very clear: more liquidity in paper money equals more reasons to own gold. SPDR Gold Shares (GLD) rallied for most of the day and made a new 13-month closing high (by a hair).

Source for charts: FreeStockCharts.com

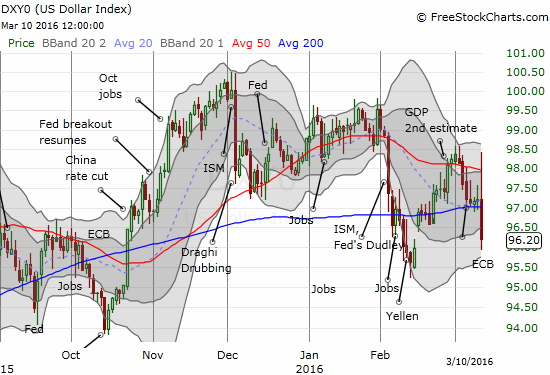

If the gold bugs have the correct interpretation of what just happened, I expect once again that the euro to sell-off at some point in the coming weeks. Perhaps the Federal Reserve next week will revive the notion of a policy divergence. At least I am pretty sure that the Fed and Janet Yellen will not announce one thing and then unwind the desired market response. In the Fed’s favor is another Draghi Drubbing which has provided fresh room for upside in the U.S. dollar index…if the Fed chooses to use it…

Be careful out there!

Full disclosure: short the euro, long and short currencies against the U.S dollar, long GLD, short EUR/TRY