It finally happened. Rio Tinto (RIO), a major producer of commodities like iron ore, has started to back off its generous dividend payout policy.

In its latest earnings statement, RIO announced its total dividend for 2015 will come to 215 U.S. cents per share, the same as it paid out in 2014. Over the past 5 years, RIO reported a payout to investors of over $25B in dividends. However, RIO can no longer afford such generosity. Going forward, the company slashed the “intended” payout almost in half and warned investors that the dividend is now subject to change to align with business realities:

“…with the continuing uncertain market outlook, the board believes that maintaining the current progressive dividend policy would constrain the business and act against shareholders’ long-term interests. We are therefore replacing the progressive dividend policy with a more flexible approach that will allow the distribution of returns to reflect better the company’s position and outlook. For 2016, we intend that the full year dividend will not be less than 110 US cents per share.”

The qualifier “intend” is important. It emphasizes the flexibility RIO has put in place to change the dividend as needed. Given the current trend and trajectory, I am assuming that this dividend will continue to get cut until, perhaps, it finally drops to zero.

The commodities market generally peaked in 2011. The path to a bottom has been excruciatingly long. RIO’s change in its dividend policy brings the collapse one step closer to a bottom. RIO has finally started to acknowledge the true severity of this collapse. Once its dividend goes completely to zero – or some major goes to zero (or bankruptcy?) – the market will probably be about as close to a good risk/reward buy as it can get.

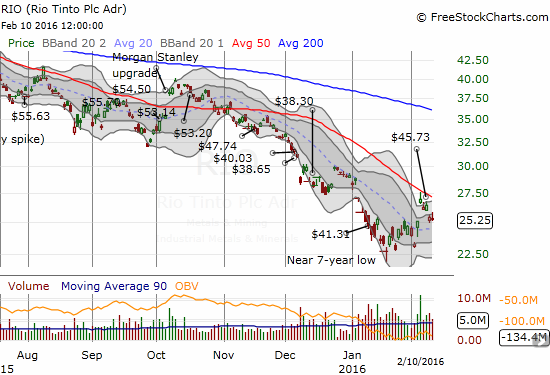

The chart below shows the on-going sell-off in RIO in recent months. It is overlayed with the price of iron ore.

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: no positions