(This is an excerpt from an article I originally published on Seeking Alpha on December 2, 2015. Click here to read the entire piece.)

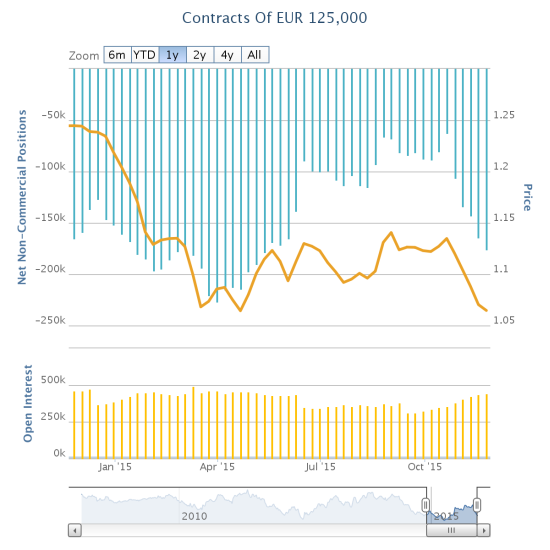

The European Central Bank (ECB) next makes a statement on monetary policy on December 3, 2015. The market is apparently eagerly anticipating an announcement from ECB President Mario Draghi that delivers something big to jumpstart inflation. For example, speculators have quickly rebuilt net short positions against the euro (FXE) going into this meeting.

Source: Oanda’s CFTC’s Commitments of Traders

While the increase in net shorts is directly correlated with lower levels of the euro, traders know full well that market can have a nasty habit of doing exactly opposite what it “should” do after rumor transitions to news. {snip}

The ECB must worry about these scenarios if it truly intends to weaken the euro further. {snip}

There are a few ways to trade this tightrope.

The easiest approach is to avoid trading until the news becomes official AND the market appears to commit to its reaction to the news. A new low on the euro (versus the U.S. dollar) or a breakout above a previous high, say 1.07 on EUR/USD, could signal a commitment.

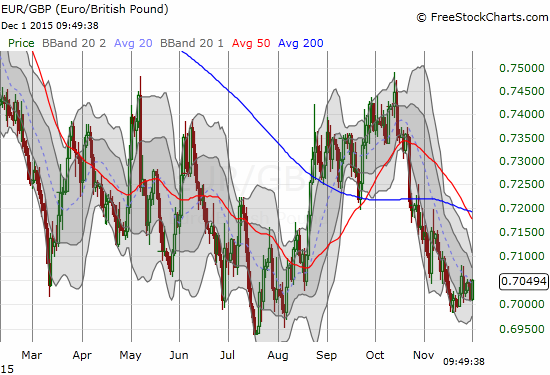

Source: FreeStockCharts.com

I provided two views to confirm that the slide in EUR/USD is not just strength in the U.S. dollar. {snip}

A slightly more risky option for traders comes from carrying just a small short position in the euro going into the ECB meeting. {snip}

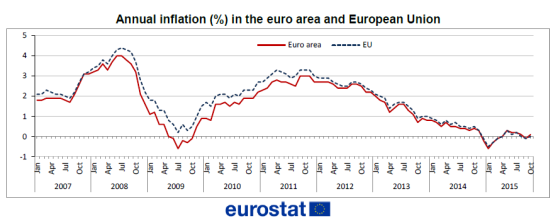

A third, even riskier, option is to stick to the overall thesis that the euro should continue weakening over time. {snip}

Source: Eurostat (November 16, 2015)

Source: Eurostat (December 1, 2015)

If the euro breaks lower post-meeting, then there is nothing to do but continue sitting on the position. If the breakout scenario unfolds, and assuming the ECB makes clear it is still trying to fight deflation (and/or increase inflation), then a trader can switch to hedging with small long euro positions for short-term trades. {snip}

I have chosen a mix of scenarios #2 and #3. {snip}

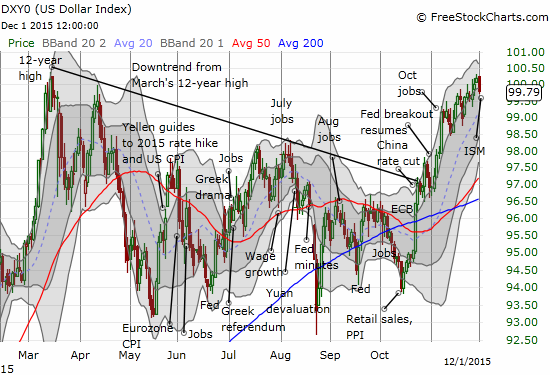

All these scenarios are of course complicated by the currency on the other side of the euro pair. {snip}

And then there is the issue of U.S. government bond yields: they are no longer increasing going into the Fed meeting despite the high odds of a rate hike. {snip}

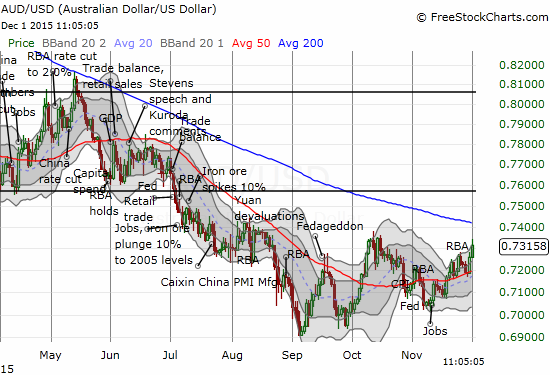

And finally there is the issue of the Australian dollar (FXA). {snip}

Source for charts: FreeStockCharts.com

In other words, connecting all these dots suggests that more selling for the euro is far from certain no matter what the ECB announces. The currency market is very ready to play the contrarian role.

Be careful out there!

Full disclosure: net long the U.S. dollar index, long call spreads on TLT, long TLT put option, net short the Australian dollar, net short the euro, net short the British pound

(This is an excerpt from an article I originally published on Seeking Alpha on December 2, 2015. Click here to read the entire piece.)