(This is an excerpt from an article I originally published on Seeking Alpha on November 16, 2015. Click here to read the entire piece.)

Clyde Russell is a columnist who often writes about iron ore for Reuters. His latest piece, “Who’s behaving rationally in iron ore, steel? Everybody and nobody,” discusses some common themes and well known problems in the industry. The article is a great reminder of how iron ore is trapped in self-reinforcing loops that continue to drag down the companies in the industry.

Where Russell identifies irrational behavior, I like to think of behavior forced and shaped by forces mostly out of reach of the individual actors. When Rio Tinto (RIO) stubbornly sticks to bullish forecasts of Chinese steel demand and refuses to take down production, it is locked into this behavior as a method of defending market share in a brutally competitive marketplace. When Chinese steel producers keep generating steel at negative margins, they are also locked into this behavior as a method of maintaining market share. Moreover, their behavior is still enabled and supported by lax credit conditions and state support.

Here is one way to describe the reinforcing dynamics:

{snip}

The drive to cut costs sits at the core of these reinforcing loops. Fortescue Metals Group is a great example of this imperative. {snip}

For perspective, Fortescue reported in its June, 2015 quarterly earnings report $2.4B cash on hand. So, Fortescue can easily fund this tender with existing cash. Given Fortescue has little likelihood of investing in further mining activity in the near future, it makes sense to move that cash to reduce interest payments and thus reduce all-in costs.

It was just 8 months ago when Fortescue ended a scramble to refinance debt. Citing unfavorable credit conditions, Fortescue ended its efforts to refinance $2.5B debt on more favorable terms. {snip}

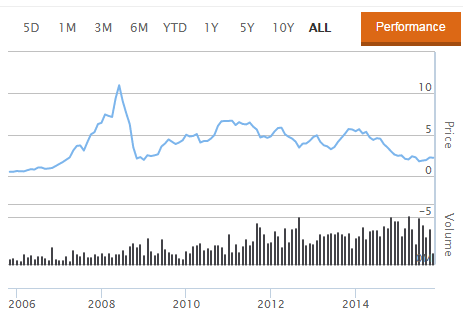

Source: Australian Stock Exchange

As a result of the destructive dynamics, I continue to believe iron ore companies should only be traded not used as investments. {snip}

Be careful out there!

Full disclosure: no positions

(This is an excerpt from an article I originally published on Seeking Alpha on November 16, 2015. Click here to read the entire piece.)