(This is an excerpt from an article I originally published on Seeking Alpha on January 29, 2015. Click here to read the entire piece.)

This year has started for SPDR Gold Shares (GLD) in a fashion eerily similar to 2014. On December 18, 2013, the Federal Reserve officially announced the planned tapering of its bond buying program, the effective winding down of quantitative easing. GLD fell 0.9% that day and then gapped down the next day, closing with an additional 2.4% loss. The drop came as no surprise since it appeared the Fed would successfully tighten policy well ahead of any inflation threat.

{snip}

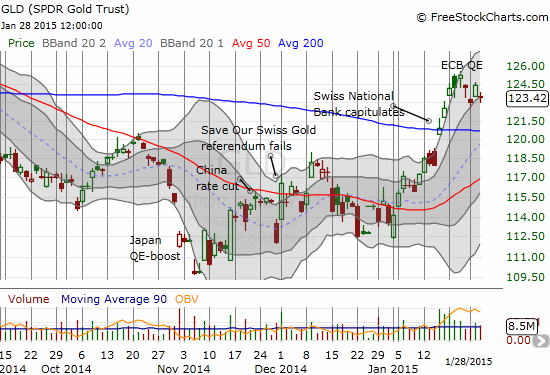

Source: FreeStockCharts.com

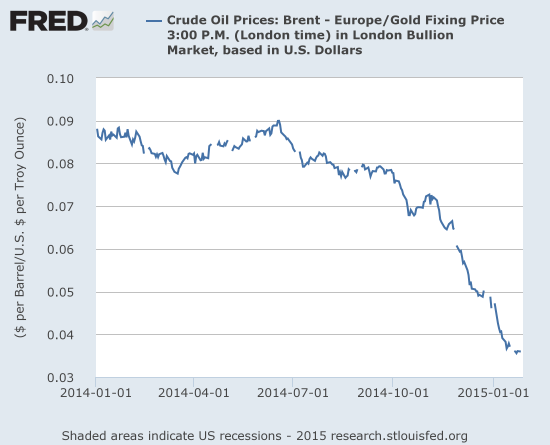

GLD is now up 8.7% year-to-date even as plunging oil prices (OIL) have sent the fear of disinlfation/deflation into the minds of central banks around the globe. The number of ounces of gold required to buy a barrel of oil has accelerated downward since GLD’s November bottom. The decline began in earnest June, 2014.

Sources: London Bullion Market Association, Gold Fixing Price 3:00 P.M. (London time) in London Bullion Market, based in U.S. Dollars [GOLDPMGBD228NLBM], retrieved from FRED, Federal Reserve Bank of St. Louis, January 28, 2015. US. Energy Information Administration, Crude Oil Prices: Brent – Europe [DCOILBRENTEU], retrieved from FRED, Federal Reserve Bank of St. Louis, January 28, 2015.

Over at the U.S. Federal Reserve, governors do not seem overly concerned. {snip}

Recently, the European Central Bank (ECB) and the Bank of Canada have specifically blamed oil for generating enough broad-based disinflationary pressure to require a monetary response. Before the latest Fed statement, I was bracing for the possibility that the Fed would fall in line and declare/hint that rate hikes were off the table for all of 2015. {snip}

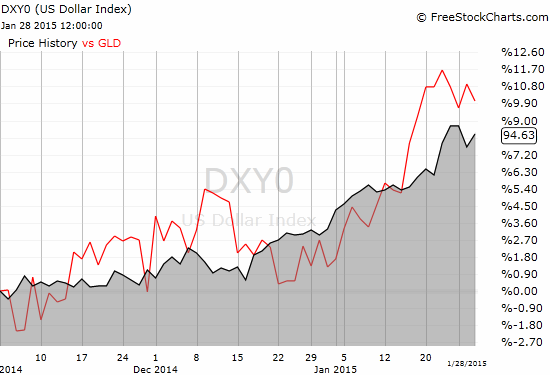

GLD’s recent rally has been even more impressive in the face of a near relentless rise in the U.S. dollar index (UUP). {snip}

Source: FreeStockCharts.com

Given I have a core position in GLD, I do not project a lower price as a reflection of my preferred outcome. {snip}

Be careful out there!

Full disclosure: long GLD

(This is an excerpt from an article I originally published on Seeking Alpha on January 29, 2015. Click here to read the entire piece.)