(This is an excerpt from an article I originally published on Seeking Alpha on Jan 22, 2015. Click here to read the entire piece.)

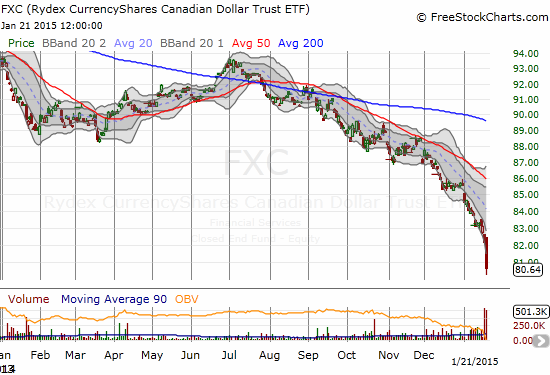

My re-evaluation of my newfound bullishness on the Canadian dollar came just in time for a surprise rate cut from the Bank of Canada (BoC). The CurrencyShares Canadian Dollar ETF (FXC) plunged 1.8% to a fresh, near 5-year low on news that the BoC decided to cut its target overnight interest rate target from 1% to 0.75%.

Source: FreeStockCharts.com

While I have noted in the past the increasing dovishness from BoC governor Stephen S. Poloz, I did not expect a rate cut at this meeting. If anything, I thought this meeting might set the stage for such an action after the market had a chance to absorb the implications of the January, 2015 Monetary Policy Report.

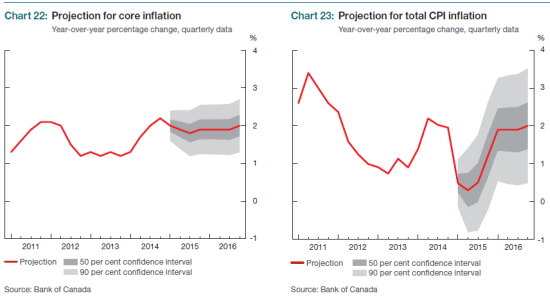

The decision essentially came down to the disinflationary impact of falling oil prices:

“This decision is in response to the recent sharp drop in oil prices, which will be negative for growth and underlying inflation in Canada…Total CPI inflation is starting to reflect the fall in oil prices.”

However, the BoC is NOT bearish on oil (USO) or on growth. {snip}

The Bank also believes that the “backdrop” of growth is strong despite the oil-driven headwinds:

{snip}

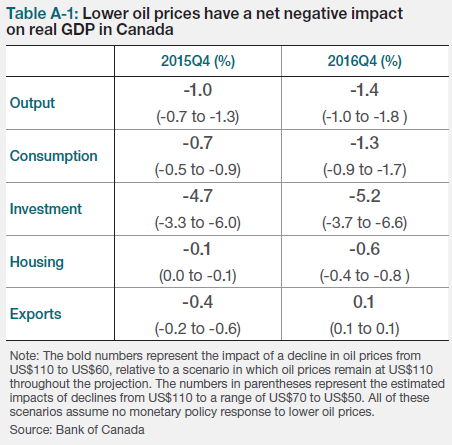

The uncertainty around the impact of oil prices is what interests me the most. Earlier, the Bank of Canada promised to answer such questions in its the January, 2015 Monetary Policy Report. The report could not be more clear on its assessment of oil’s net negative impact on the Canadian economy:

“The considerably lower profile for oil prices will be unambiguously negative for the Canadian economy in 2015 and subsequent years.”

{snip}

The BoC went on to describe specific ways in which the oil shock propagates beyond Canada’s oil-producing regions:

{snip}

With the natural uncertainty in any forecast, the BoC has to worry about the potential for a much greater retrenchment should current expectations on oil prices still prove overly optimistic.

Shining through all these concerns is the U.S. economy. Once again, the BoC is expecting good things from the U.S. that will in turn help bolster the Canadian economy through exports (emphasis mine):

{snip}

The BoC is also looking forward to some positive feedback from global growth driven by lower oil prices, moderated by the negative impacts on other oil-producing countries. The BoC’s net optimism on global growth comes from a conclusion that the oil shock is more of a supply-side issue. {snip}

The BoC also expects consumers to direct some of their oil savings to paying down debt as part of an on-going deleveraging process in the economy.

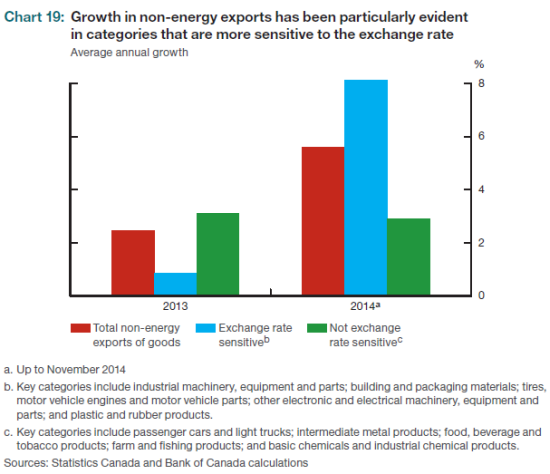

A weaker Canadian dollar is the mechanism through which economic strength in the U.S. will translate into stronger economic performance in Canada. First, the fall in oil prices helps drive the Canadian dollar lower. Second, the weaker currency helps drive better performance in the non-energy sector.

{snip}

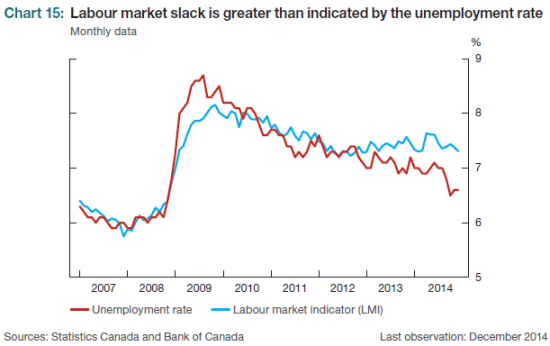

In earlier pieces, I relied on surprisingly strong labor reports as part of an increasingly bullish thesis on the Canadian dollar as a contrarian play. It turns out that the BoC looks at a different measure of the health of the labor market called the Labour Market Indicator (LMI). As the graph below demonstrates, LMI did not improve along with the unemployment rate in 2014:

{snip}

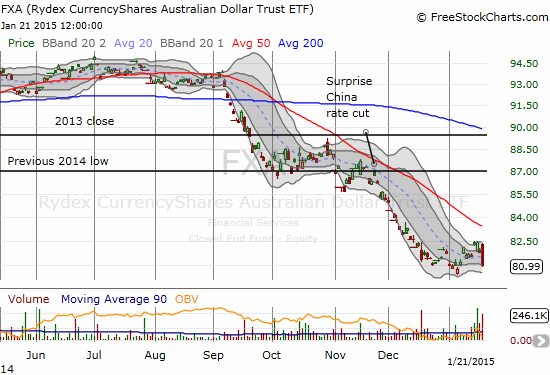

Source: FreeStockCharts.com

{snip}

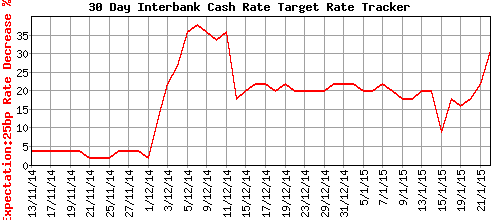

Source: ASX RBA Rate Indicator

I think these odds are far too low. The Bank of Canada’s action all but ensure the U.S. Federal Reserve will see little reason to hike rates at all this year. Assuming the RBA makes the same conclusion, it will have to drop its hope that the U.S. dollar will do all the work of currency depreciation for Australia.

Be careful out there!

Full disclosure: short the Australian dollar

(This is an excerpt from an article I originally published on Seeking Alpha on Jan 22, 2015. Click here to read the entire piece.)