(This is an excerpt from an article I originally published on Seeking Alpha on Jan 14, 2015. Click here to read the entire piece.)

“The recent movements in oil prices have been dramatic, but they are not random. Once we sort through the different economic forces at play, we see that underlying the recent drop in oil prices is a surge in unconventional oil supply against the backdrop of slower growth of global demand. Over time, higher-cost oil is still likely to be needed to satisfy growing global demand, but prices could go lower, or remain low, for a significant period before those medium-term forces do their work.” (emphasis mine)

This was the conclusion from Timothy Lane, Deputy Governor of the Bank of Canada, in a speech called “Drilling Down – Understanding Oil Prices and Their Economic Impact.” {snip}

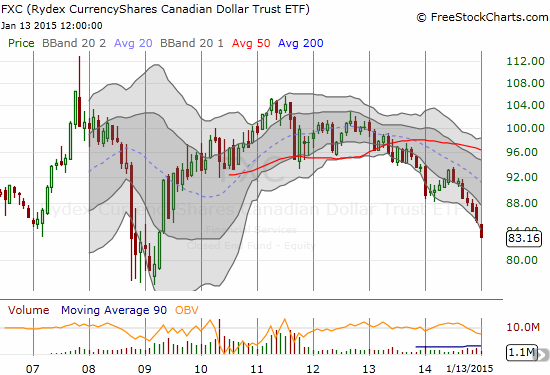

Source: FreeStockCharts.com

Lane made several important points that suggest that the Canadian dollar will stay weaker for some time:

{snip}

Implication: monetary policy will remain accomodative and the Bank of Canada still prefers a weaker currency. All else being equal, accomodative monetary policy supports a weaker currency and a weaker currency tends to boost Canadian exports (primarily to the U.S.)

{snip}

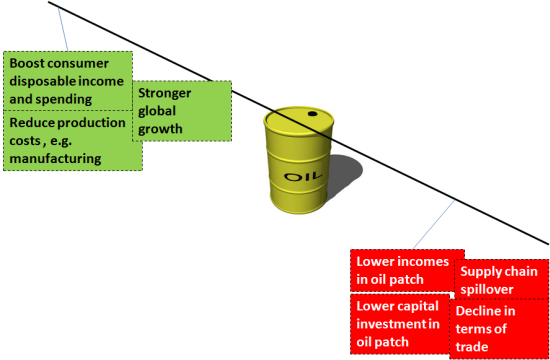

On balance, Lane concludes that lower oil prices are bad news for Canada. The Bank of Canada will attempt to a specific quantification of the potential impacts in next week’s Monetary Policy Report. In the meantime, here is my representation of the factors weighing on Lane’s assessment of oil’s impact on the Canadian economy:

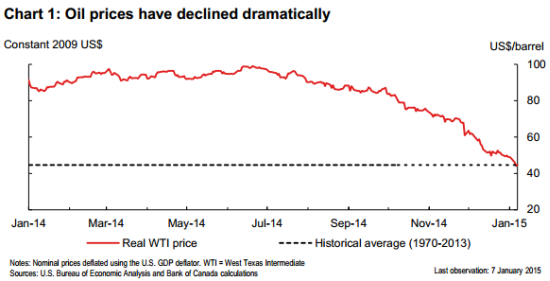

Since Lane believes that the oil decline is short-term in nature, this balance of negative effects is also temporary. Over the “longer-term”, Lane is relying on the on-going (and massive) urbanization of populations in China and India to support oil demand. At some point again, higher cost oil will be needed to fill this demand and growing demand from other emerging economies. The following chart from Lane’s speech shows that oil prices have returned to a presumed long-term average, suggesting that even with an overshoot to the downside, the end of the decline should be approaching.

Source: Bank of Canada

So, somewhere over the horizon awaits a strong Canadian dollar. The timing of this turn will at least await the next correction in oil’s supply dynamics. {snip}

Be careful out there!

Full disclosure: short USD/CAD, net long the U.S. dollar

(This is an excerpt from an article I originally published on Seeking Alpha on Jan 14, 2015. Click here to read the entire piece.)