(This is an excerpt from an article I originally published on Seeking Alpha on March 27, 2014. Click here to read the entire piece.)

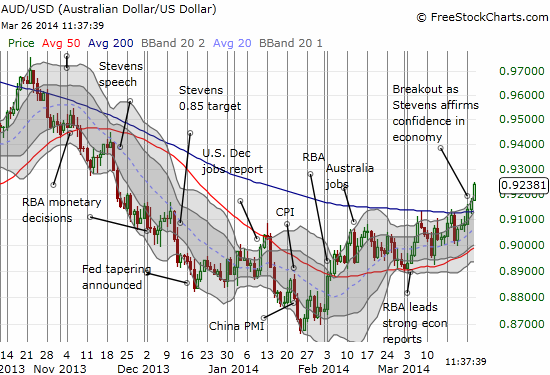

The Australian dollar (FXA) has been incredibly resilient in recent weeks. Weak economic data from China and concerns about excessive debt in the Chinese economy have barely dented the recent momentum. As of the time of this writing, the Australian dollar is printing a potentially important breakout above its 200-day moving average (DMA).

Source: FreeStockCharts.com

As the chart above shows it was only three months ago when Glenn Stevens, the governor of the Reserve Bank of Australia (RBA), suggested that 0.85 is a fair target for the Australian dollar versus the U.S. dollar. With this context, I half-expected Stevens to treat his Wednesday speech to the 17th Annual Credit Suisse Asian Investment Conference as another opportunity to tease the market into doing the RBA’s bidding. Instead, Stevens seemed to take great pains to avoid jawboning as he sang the praises of the Australian economy. At one point, Stevens even suggested that he is not (no longer?) interested in trying to tweak the exchange rate as a tool for economic growth:

“Strong long-run growth won’t be achieved in any country simply by manipulating interest rates (or, for that matter, exchange rates).”

There were only two moments when Stevens even bothered to question the market’s pricing mechanism for exchange rates. {snip}….

Be careful out there!

Full disclosure: net short the Australian dollar

(This is an excerpt from an article I originally published on Seeking Alpha on March 27, 2014. Click here to read the entire piece.)