(This is an excerpt from an article I originally published on Seeking Alpha on May 20, 2014. Click here to read the entire piece.)

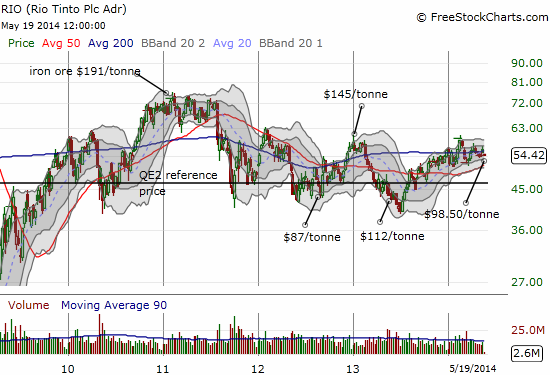

The miners of iron ore spent the last few years ramping up production capacity, and now they are ramping up production. The price of iron ore has steadily fallen in 2014 as inventories in China have steadily risen. Bloomberg quoted figures from Shanghai Steelhome Information Technology Co. indicating that China is now sitting on a record 112.55M metric tons of iron ore. Iron ore producers have thrived during this period as volume has made up for price on top of very low production costs. Rio Tinto (RIO) starts losing money at a mere $44/metric ton; BHP Billiton Limited (BHP) at $56/tonne (data from “Miners in spotlight as iron ore drops below $US100 per metric tonne). {snip}

{snip}

{snip}

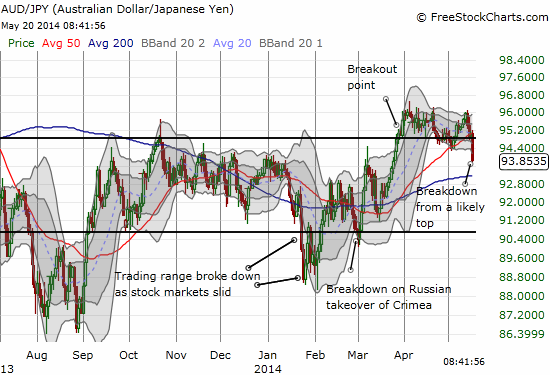

The Australian dollar is important in this context as a barometer for the market’s general sentiment toward economic conditions in China. {snip}

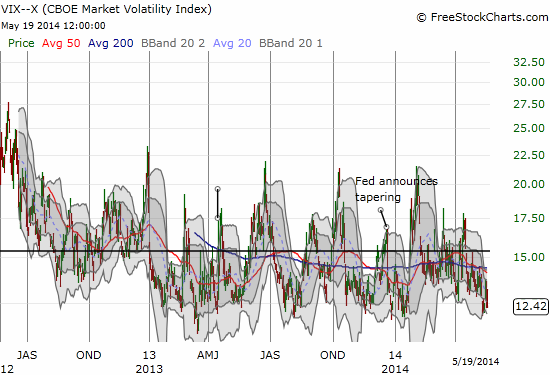

With stock market volatility trading at the bottom of its range, conditions are ripe for a sudden pullback. Since the beginning of 2013, volatility has tended to spend very little time at current levels. In other words, there is little tolerance for something going wrong – a continued drop in iron ore prices and a sliding Australia represent “something going wrong” in the current context.

Source for charts: FreeStockCharts.com

I believe the following commentary from the opening remarks of the Bank of England’s Governor Mark Carney in last week’s Inflation Report should prove prescient:

“While risks around the euro area are now two-sided around a modest growth rate, there are downside risks from the consequences of the rapid growth of shadow banking in China. More broadly the MPC is alert to vulnerabilities from a reassessment of risk in financial markets, perhaps prompted by geopolitical developments or uncertainties about the normalisation of monetary policy. Despite a more complex global environment, implied volatilities in many markets are well below their long-term averages.

Heading back to normal will likely be accompanied by more normal, that is higher, levels of volatility.”

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on May 20, 2014. Click here to read the entire piece.)

Full disclosure: net short the Australian dollar