(This is an excerpt from an article I originally published on Seeking Alpha on March 16, 2014. Click here to read the entire piece.)

{snip}

Central bankers continue to warn financial markets to properly price in risk. On March 13th, Chris Salmon, the Executive Director of Markets at the Bank of England (BoE) continued the parade when he delivered a related speech titled “Financial Market Volatility and Liquidity – a cautionary note” at the National Asset-Liability Management Europe symposium in London. {snip}

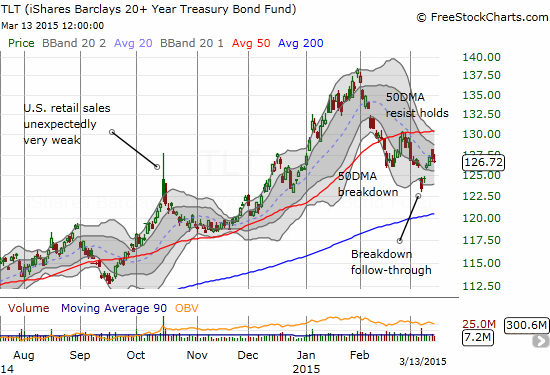

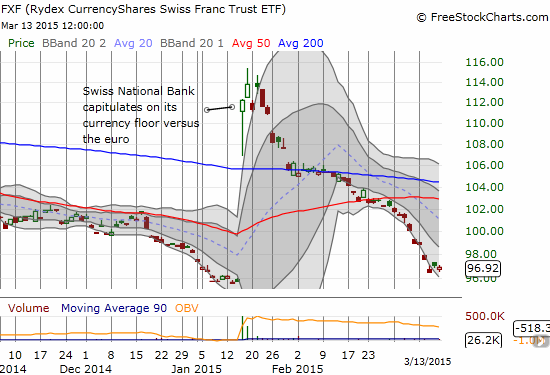

The charts below for iShares 20+ Year Treasury Bond (TLT) and CurrencyShares Swiss Franc ETF (FXF) provide reminders of the shocks that provided Salmon’s key examples:

Source: FreeStockCharts.com

In both cases, liquidity returned to the market very quickly and follow-on contagion did not occur. {snip} Salmon took comfort in this demonstration of robustness, but he was careful to note that markets should not overly rely on this amount of robustness:

{snip}

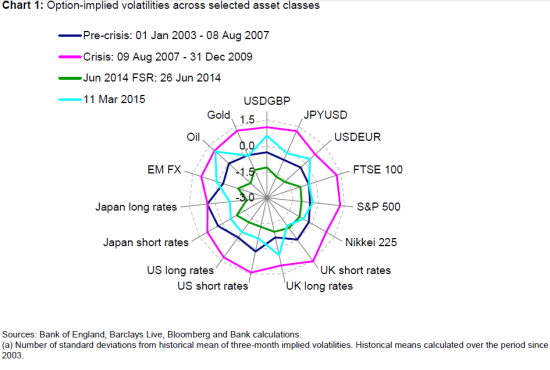

Salmon concludes that these episodes show markets are more sensitive to news and cites confirming statistical studies. He explains this extra sensitivity comes from the increased uncertainty regarding the outlook for global growth – thanks in large part to the collapse in oil prices. {snip}

The moment that markets decide holding cash makes more sense than paying governments to hold it could become yet another source of extra volatility for bond markets. {snip}

{snip}

{snip}

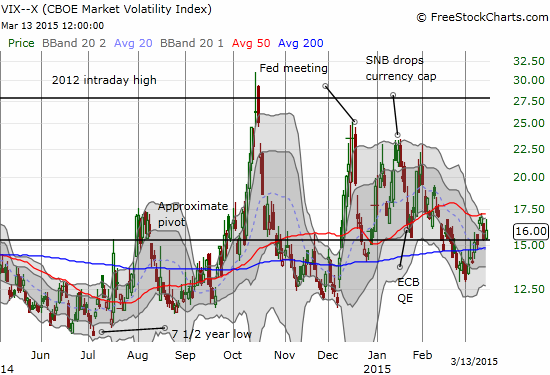

Source: FreeStockCharts.com

Even though markets are getting more sensitive to news, this sensitivity does not explain the severity of the shocks in the Swiss franc and the bond market. For this Salmon turns to liquidity-related market structure:

{snip}

The most refreshing part of Salmon’s speech came near the beginning when he actually acknowledged the role central banks have played in artificially dampening volatility and incentivizing markets to under-price risk up to now… {snip}

The benefit for those of us listening to this drumbeat of warnings from central banks is that we have actually been given the luxury of time to prepare. {snip}

Be careful out there!

Full disclosure: net short the Swiss franc, net long the U.S. dollar and the British pound, long UVXY call options

(This is an excerpt from an article I originally published on Seeking Alpha on March 16, 2014. Click here to read the entire piece.)