(This is an excerpt from an article I originally published on Seeking Alpha on December 4, 2014. Click here to read the entire piece.)

The Bank of Canada once again left its overnight target interest rate at 1% in its latest monetary policy decision. An important change this time around came in the form of the economic outlook:

{snip}

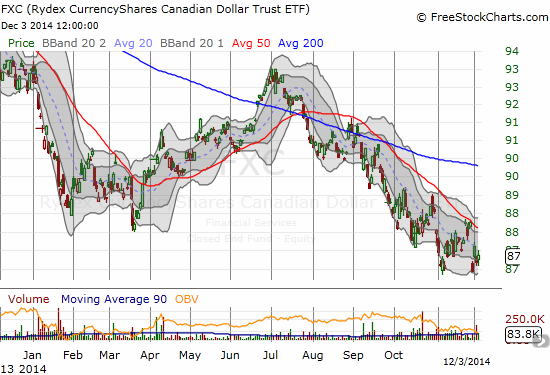

The continued strength in the U.S. economy is benefiting Canadian exporters and allowing Canada to overlook economic weakness elsewhere across the globe. On balance, the Bank of Canada is recognizing a potentially important and notable juncture in the economic outlook for Canada. Even though plunging oil and other commodity prices will be a drag on Canadian performance for some time, I do not think this dynamic is a sufficient reason to stay bearish on the Canadian dollar (FXC), especially when this sector was able to deliver significant upside to last month’s GDP numbers. {snip}

The time to buy the Canadian dollar is not when it appears “safe” because all of Canada’s economic cylinders are firing in full throttle. {snip}

The volatility and noise in the oil patch and the overwhelming rush of the U.S. dollar (UUP) should continue to drown out the longer-term bullish signs for the Canadian dollar. {snip}

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: long the Canadian dollar

(This is an excerpt from an article I originally published on Seeking Alpha on December 4, 2014. Click here to read the entire piece.)