(This is an excerpt from an article I originally published on Seeking Alpha on November 20, 2014. Click here to read the entire piece.)

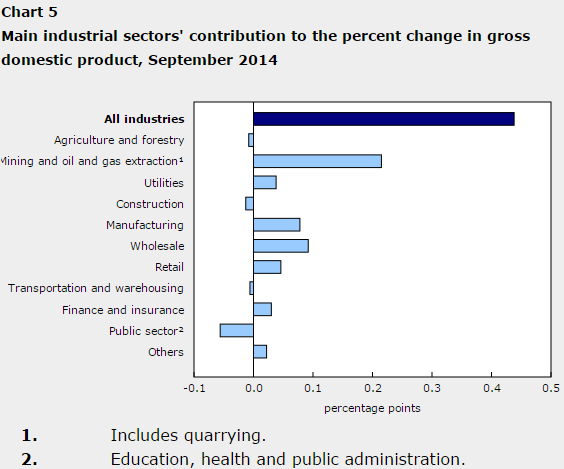

Once again, traders overlooked another strong economic report from Canada. This time the strong report came in the form of GDP growth. The distracting event was a tremendous plunge in oil prices in the wake of OPEC’s confirmation that it cannot cooperate to artificially prop up prices.

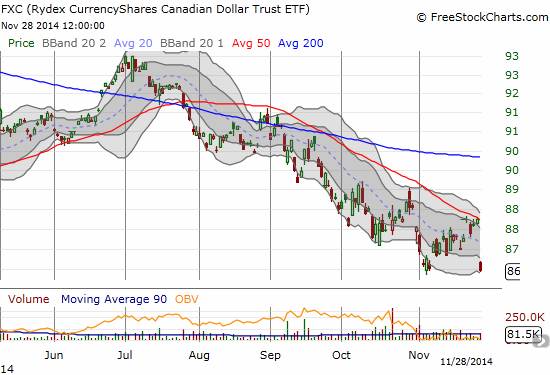

Traders focused on the bearish implications of plunging oil prices on Canada’s economy helped send the CurrencyShares Canadian Dollar ETF (FXC) plunging 1.75%. On a closing basis, FXC retested levels last seen in the summer of 2009.

Source: FreeStockCharts.com

The GDP report was unabashedly bullish, including a healthy increase in exports:

{snip}

I have to assume that the on-going weakening of the Canadian dollar is finally passing through into the real economy.

Perhaps most importantly, incomes increased throughout the Canadian economy:

{snip}

This expansion in incomes helped drive the household debt service ratio (household mortgage and non-mortgage interest paid divided by disposable income) to its lowest level on record – an impressive achievement even as consumption and the economy grow robustly.

The one notable negative in the GDP report was a second quarterly decline in Canada’s terms of trade. {snip}

Source: Statistics Canada

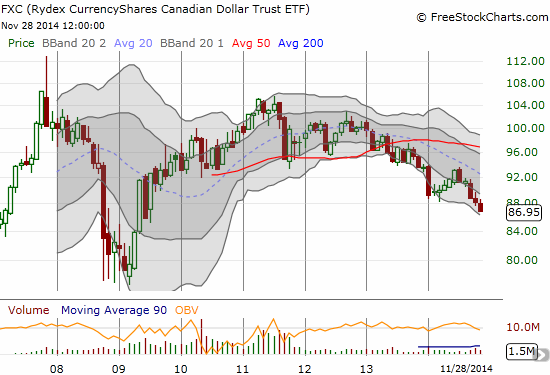

I am not letting the negatives dissuade me from getting MORE long the Canadian dollar continue to change my stripes on the currency. I find the contrarian possibilities too tempting given so many others are distracted by the plunge in oil. Admittedly, I hate to fight a trend as persistent as the decline in the Canadian dollar over the past three years, but the USD/CAD currency pair has come “close enough” to my original bearish target of 1.16 to interest me in starting a trade in the opposite direction.

Be careful out there!

Full disclosure: long USD/CAD

(This is an excerpt from an article I originally published on Seeking Alpha on November 20, 2014. Click here to read the entire piece.)