(This is an excerpt from an article I originally published on Seeking Alpha on December 8, 2014. Click here to read the entire piece.)

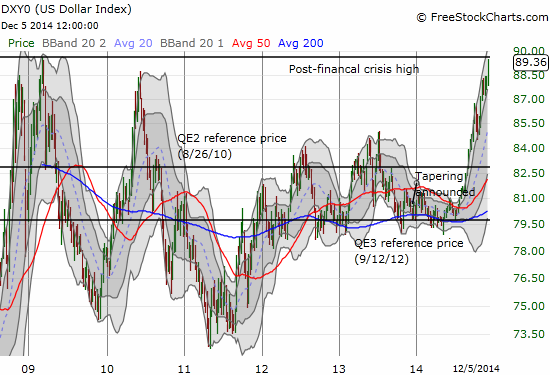

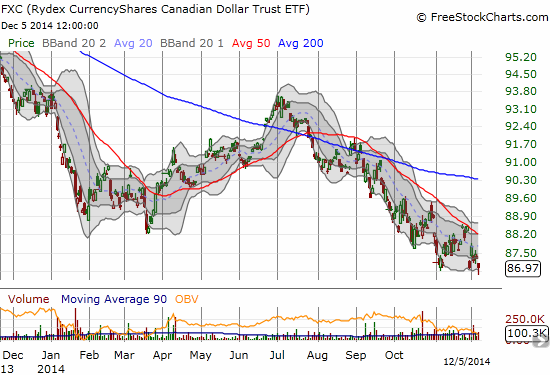

Canada experienced two extremely strong monthly jobs reports going into the report for November, 2014. Both positive reports were generally overlooked by currency markets. This time around, Canada’s job report did not contain any exciting news, and it was understandably overshadowed by a very strong November U.S. jobs report. It was definitely the U.S.’s “turn” to shine as job creation in 2014 now looks to outpace anything we have seen since the 1990s. This news helped drive the U.S. dollar index toward a retest of post-crisis highs (UUP). This surge in turn took down CurrencyShares Canadian Dollar ETF (FXC) before it recovered slightly into the day’s close.

Source: FreeStockCharts.com

Of course, Canada’s high level of dependence on the U.S. for its exports means that good news in the U.S. is good news for Canada. {snip}

As always, I take these things one step at a time. The current step is the Canadian jobs report…

In Canada, the unemployment rate ticked up 0.1 percentage point to 6.6% while all major job categories held flat to November, 2013 levels as reported by Statistics Canada. {snip}

The oil and gas industry is tucked within a category called “forestry, fishing, mining, quarrying, oil and gas” – also known as natural resources – that falls under the “goods-producing sector.” The natural resources classification has held a fairly steady share of employment in Canada. Since 2009, its share of the goods industry has ranged from a high of 10% in March, 2014 to a low of 8.4% in several months of 2009.

{snip} So, oil and gas employment is just a small portion of the overall Canadian labor market, and its share has remained stable since at least 2009. If this stability continues through the current price decline, it stands to reason that the Canadian economy can continue its strong performance…and the currency should soon enough end the weakness entrenched since the post-crisis peak in 2011.

Be careful out there!

Full disclosure: short USD/CAD

(This is an excerpt from an article I originally published on Seeking Alpha on December 8, 2014. Click here to read the entire piece.)