(This is an excerpt from an article I originally published on Seeking Alpha on April 7, 2014. Click here to read the entire piece.)

There was a lot of action last week in the foreign exchange market. This piece is a quick update on how I have adjusted and/or maintained positioning in select currencies: the euro (FXE), the British pound (FXB), the Canadian dollar (FXC), and the Australian dollar (FXA).

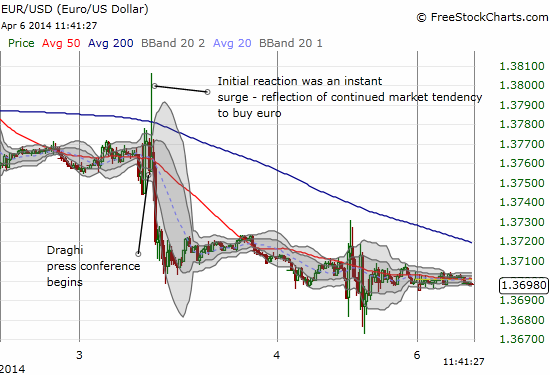

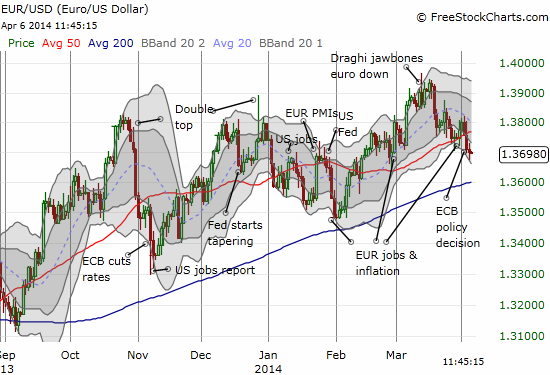

Euro

Last week on April 3rd, the European Central Bank (ECB) rolled out its latest update on monetary policy. President Mario Draghi reminded markets that risks in the euro area remain to the downside. There were some other points that caught my interest.

Investors continue to show interest in euro area assets. This interest no doubt explains at least some of the stubborn strength in the euro.

{snip}

I believe the clincher for the euro came during the Q&A period when Draghi confirmed that the ECB’s Governing Council discussed the possibility of implementing QE. Draghi also re-emphasized the importance of the exchange rate, an emphasis I think has been largely missing until now…even if the exchange rate itself is still not a “policy target”:

{snip}

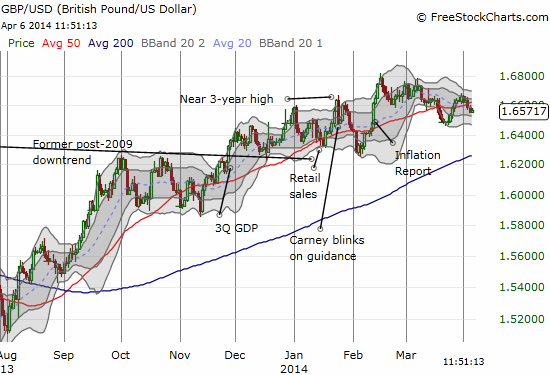

British Pound

I do not think there is much to say about the British pound right now. Economic data are generally supporting the recovery theme for the UK. {snip}

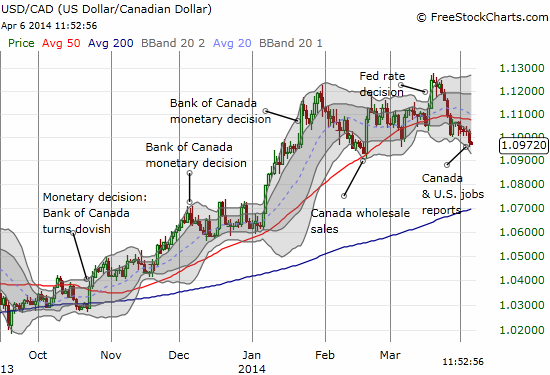

Canadian dollar

The Canadian dollar has had a strong comeback since getting slammed by the Federal Reserve’s March monetary policy announcement. {snip}

Australian dollar

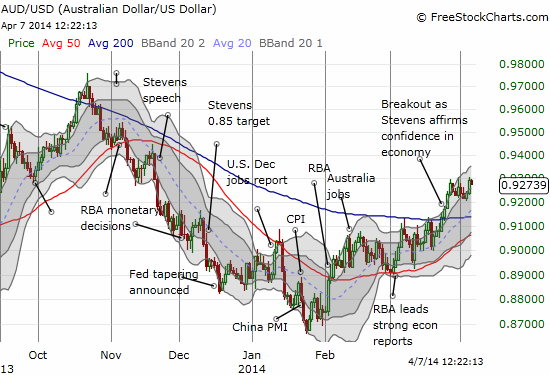

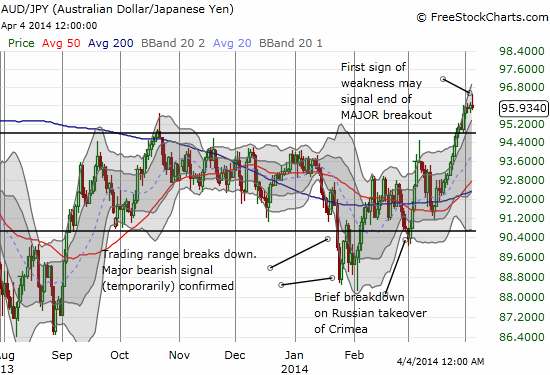

The Australian dollar is firmly in breakout mode against the U.S. dollar (AUD/USD). However, its run against the Japanese yen (AUD/JPY) finally seems to be ending. {snip}

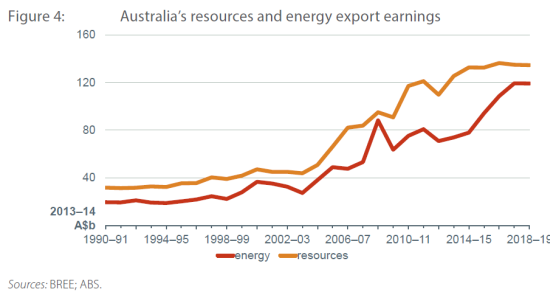

Source: the Bureau of Resources and Energy Economics

Sure this rise is supported by expanded production capacities and the demand to absorb it. However, if I had not known the expectations for a peak in the terms of trade, I would have looked at this chart and assumed the terms of trade remained bullish. {snip}

So, on balance, I am staying net short the Australian dollar rather than switching to match the bullish technicals that defy the fundamentals. {snip}

Source for charts: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 7, 2014. Click here to read the entire piece.)

Full disclosure: net short the euro, Australian, and Canadian dollars. Long the British pound.