(This is an excerpt from an article I originally published on Seeking Alpha on January 22, 2014. Click here to read the entire piece.)

Remember last September when the Reserve Bank of Australia (RBA) somewhat mysteriously removed the following language from its statement on monetary policy?…

“The Board also judged that the inflation outlook, as currently assessed, may provide some scope for further easing, should that be required to support demand.”

On January 22, 2014 (Australian timezone), the Australian Bureau of Statistics (ABS) reported somewhat heated inflation numbers for Q4 of 2013 that all but remove the prospect for further rate cuts from the RBA in the February meeting. {snip}

The 0.9% rise in quarterly underlying CPI one of the highest on record

— Stephen wefKoukoulas (@TheKouk) January 22, 2014

Several categories experienced strong price gains in the quarter and the year, further testament to a firm inflation picture. {snip}

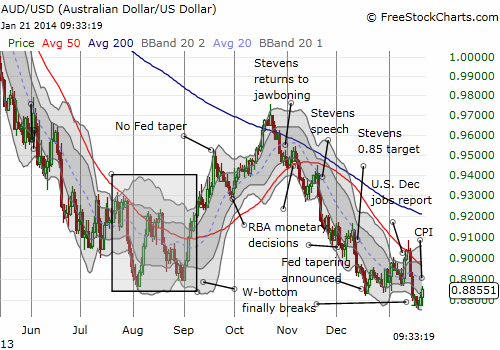

The response in the Australian dollar (FXA) was immediate and sharp…

Source: FreeStockCharts.com

Despite the CPI, I am going to maintain a (short-term) bearish bias for now on the Australian dollar. This one CPI report may not fundamentally shift negative market sentiment in the short-term. The market will likely look for affirmation from the RBA statement in another two weeks before moving toward the next sustainable direction. I am ready to go bullish if the RBA is ready.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on January 22, 2014. Click here to read the entire piece.)

Full disclosure: net short Australian dollar