(This is an excerpt from an article I originally published on Seeking Alpha on January 27, 2014. Click here to read the entire piece.)

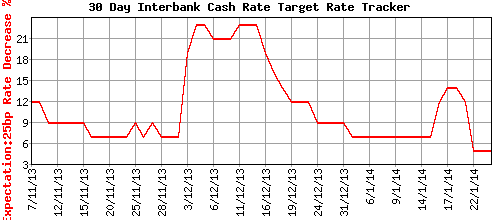

It looks like the rate implications of creeping inflation in Australia still outweigh disappointing job news and the latest China PMI reading. The market’s odds for a rate reduction dropped from 12% to 5% after inflation came in hotter than expected. Those odds have remained steady ever since.

Source: ASX Rate Tracker

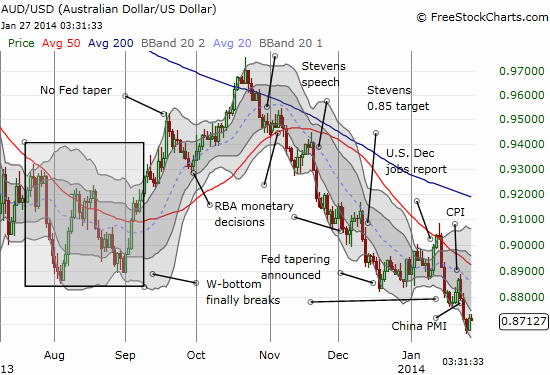

These steady odds have not prevented the Australian dollar (FXA) from selling off. The Australian dollar ended last week at fresh three and a half year lows.

A relief rally from current levels is likely, especially after the U.S. Federal Reserve meeting on Wednesday. {snip}

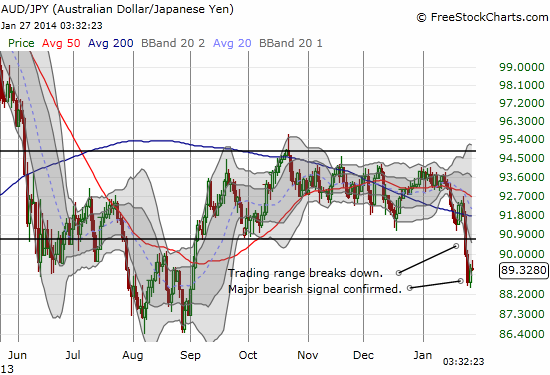

Most notable for me last week was the breakdown in the Australian dollar versus Japanese yen (FXY) currency pair (AUD/JPY). As I suspected, a big move in this pair coincided with a similar move in the stock market (note I originally guessed resolution of the AUD/JPY would be to the upside). Sure enough, the two-day sell-off in the S&P 500 and other global stock markets accompanied the breakdown. {snip}

Source for charts: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on January 27, 2014. Click here to read the entire piece.)

Full disclosure: net short Australian dollar and Japanese yen