(This is an excerpt from an article I originally published on Seeking Alpha on December 23, 2013. Click here to read the entire piece.)

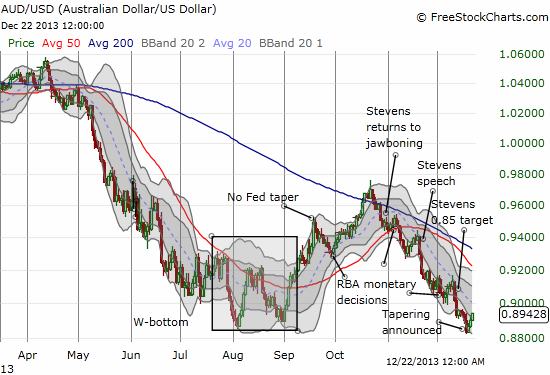

The Australian dollar (FXA) has finally retested the “W-bottom” from August of this year. So far the test seems successful as the Australian dollar has sharply bounced off the lows over the past three days.

Source: FreeStockCharts.com

One of the more notable features of AUD/USD is how well it has responded to the jawboning of Governor Glenn Stevens. His active verbal intervention into the currency reached a climax when on December 12th he fixated the market’s attention on a downside target of 0.85 for the Australian dollar versus the U.S. dollar:

{snip}

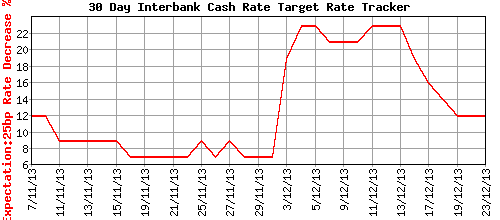

Source: RBA Rate Tracker

Interestingly, the accelerating weakness in the Australian dollar did not help the Australian stock market this time around like it seemed to do earlier in the year. {snip}

Source: ASX

{snip}

{snip}

It seems that if Stevens really wants to drive the Australian dollar closer to his 0.85 target, he WILL need to further lower rates. If the Australian dollar remains so closely bound to the 10-year bond yield, even creative jawboning may not be enough.

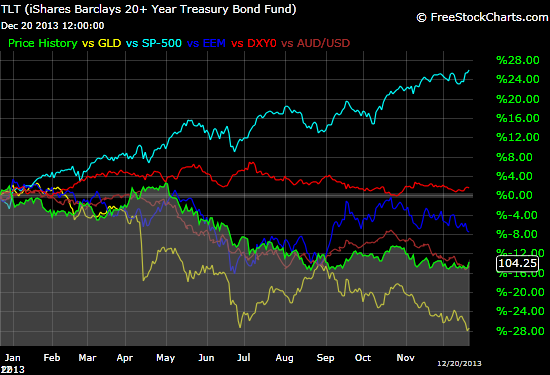

Early this year I was still in the habit of correlating the Australian dollar (FXA) to the S&P 500 (SPY) and using the Australian dollar as an early indicator of direction for the index. That correlation completely broke down once the Reserve Bank of Australia (RBA) cut rates on May 7th from 3.0% to 2.75%. {snip}

So, for now at least, it seems clear that the proper correlation is between the Australian dollar and U.S. bond yields and NOT the U.S. stock market. This relationship should be a key metric to watch for 2014.

{snip}

Source: FreeStockCharts.com

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 23, 2013. Click here to read the entire piece.)

Full disclosure: net long Australian dollar, long EEM calls and puts, long GLD, long SSO put and call options, long SPHB and SPLV, long TBT