(This is an excerpt from an article I originally published on Seeking Alpha on December 27, 2013. Click here to read the entire piece.)

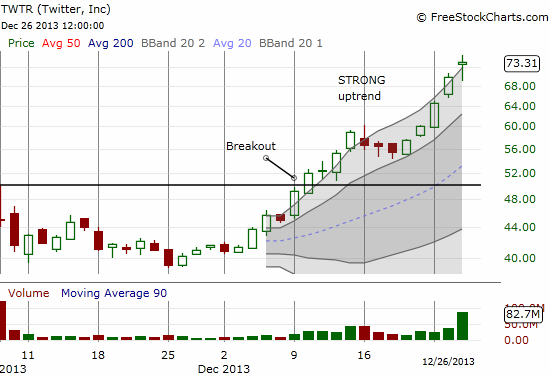

Twitter (TWTR) is up 22% so far in this holiday shortened week and up 41% since December 10th when the stock broke out to its first post-IPO high. TWTR has been the gift that keeps on giving, but the run-up seems to be reaching a crescendo.

Source: FreeStockCharts.com

The apparent news helping this week’s run-up was the announcement by The Walt Disney Company (DIS) that it elected Jack Dorsey, co-founder and chairman of TWTR, as an independent director. {snip}

Skipping over the exciting (titillating?) implications that this move could portend some kind of closer relationship between Disney and Twitter sometime in the future, it definitely brings the Twitter (and Square – Dorsey’s other tech company) brand deeper into the consciousness of mainstream investors and media circles. It is a big win for both Disney and Twitter.

However, Twitter is an expensive stock that has gotten extremely expensive. {snip}

Given the momentum in TWTR there is certainly every reason to believe the stock could continue rallying right along with the general stock market. {snip}

With so much negativity already fighting the trend, why talk about a crescendo? There should be plenty of reluctant buyers left to take Twitter higher.

First, notice in the chart above the tremendous surge in trading volume. {snip}

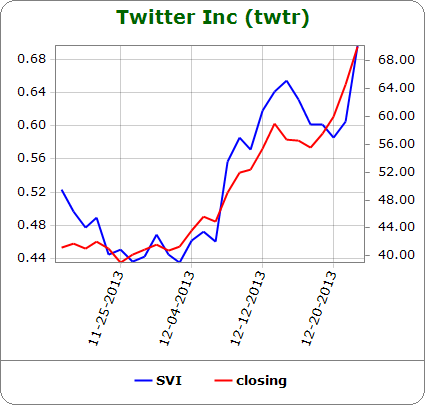

Second, implied volatility is on the rise. {snip}

{snip}

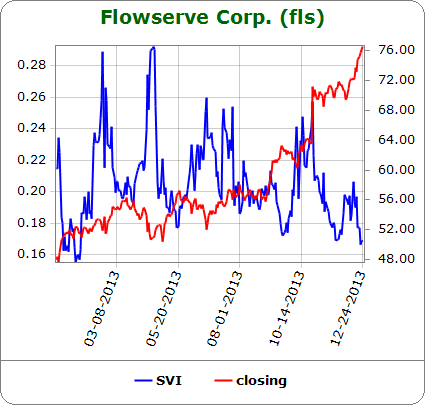

Source: Schaeffer’s Investment Research

TWTR’s increase in implied volatility is not sufficient to flag an imminent decline. Note that it has risen throughout much of the recent rally. I am only raising this flag when including the context of the extreme in trading volume.

This assessment of a crescendo weakens if TWTR overcomes the odds by printing fresh all-time highs again in the coming days. Such a move would suggest fresh buying power exists behind the stock and that the uptrend remains the dominant feature the stock (of course I think this is the low probability path). The bearish warnings for TWTR are not confirmed until sellers manage to close TWTR below the low of the day ($69.13). {snip}

Stay tuned and be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 27, 2013. Click here to read the entire piece.)

Full disclosure: no positions