(This is an excerpt from an article I originally published on Seeking Alpha on October 28, 2013. Click here to read the entire piece.)

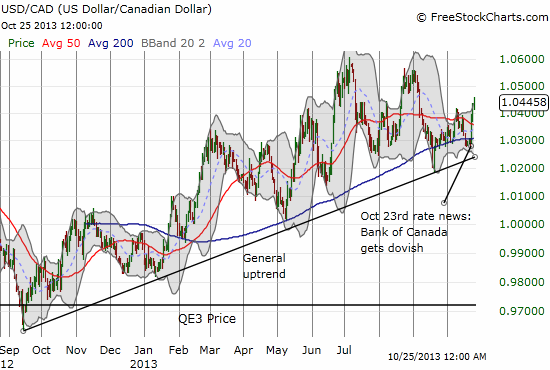

Canadian monetary policy may have experienced an important change-up. With last week’s announcement on monetary policy, the Bank of Canada became a little more dovish. The sharp response in the Canadian dollar (FXC) made me take notice.

Source: FreeStockCharts.com

{snip}

In July, the Bank of Canada made the following forecast (emphasis mine):

{snip}

The Bank updated that forecast as follows…{snip}

{snip}

This downgrade further reduces the likelihood that interest rates will increase in Canada anytime soon. Indeed, the Bank omitted an important part of its statement that has always put Canadians on notice that the bias for rates was up.

{snip}

This statement effectively opens the door to rate cuts and questioners during the press conference latched onto this possibility like glue. They were unable to get Governor Stephen S. Poloz to acknowledge directly that rate cuts were indeed coming or even a higher possibility.

{snip}

I remain bearish on the Canadian dollar with an ultimate target of 1.08 on USD/CAD. I have argued that the Canadian dollar’s strength is hindering the export part of the economy. Poloz argued against this notion in the Q&A in response to a related question. {snip}

{snip}

On balance from these responses, I still think the Canadian dollar both needs to and will head lower in the “medium term” to support economic growth. Only a notable shift in Canada’s exports away from the U.S. to, for example, Asian markets will change my assessment.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on October 28, 2013. Click here to read the entire piece.)

Full disclosure: no positions