(This is an excerpt from an article I originally published on Seeking Alpha on October 24, 2013. Click here to read the entire piece.)

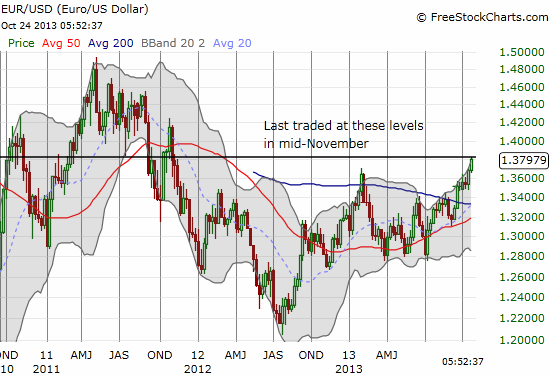

When I saw the Wednesday (October 23, 2013) headlines screaming that European Central Bank (ECB) President Mario Draghi indicated he had no hesitation about failing banks in upcoming, comprehensive stress tests, I assumed the euro (FXE) would tumble fast and hard. European stocks responded as expected, in fact the plunge in major indices was the largest since late August. However, the euro barely blinked.

{snip}

Next up was the eurozone’s PMI reading for services. The “expectation” was for a relatively healthy 52.2 but instead it came in at 50.9, scraping contraction levels. {snip}

{snip}

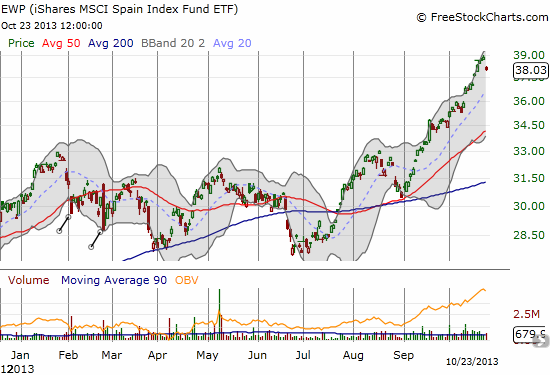

Finally, here is a chart of the iShares MSCI Spain Capped ETF (EWP) just to confirm that eurozone stocks were hit hard by the Draghi news. {snip}

{snip}

This resilience in the euro is the U.S. dollar’s weakness. {snip}

Source for charts: FreeStockCharts.com

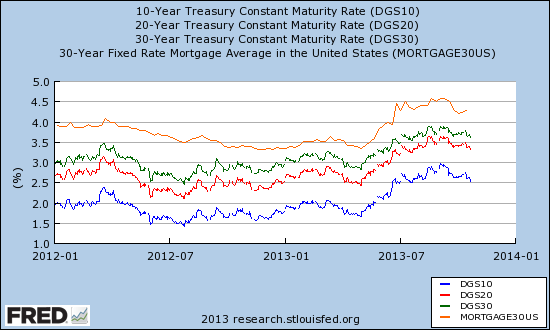

The main culprit for U.S. dollar weakness appears to be cooling expectations over the Fed’s original plans to begin tapering by the end of this year. Given the fiscal fiddling and squabbling in the U.S. government, the Fed is not likely to even think about tapering again until sometime in early 2014, eons away for foreign exchange markets. {snip}

Source: St. Louis Federal Reserve

I still prefer to use the British pound (FXB) to bet against the U.S. dollar given I remain bullish on the UK economic recovery. I remain skeptical about the euro’s rise, and I figure the currency is much higher than desired by the ECB given the still fragile nature of the eurozone economy. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on October 24, 2013. Click here to read the entire piece.)

Full disclosure: net short euro, net long U.S. dollar