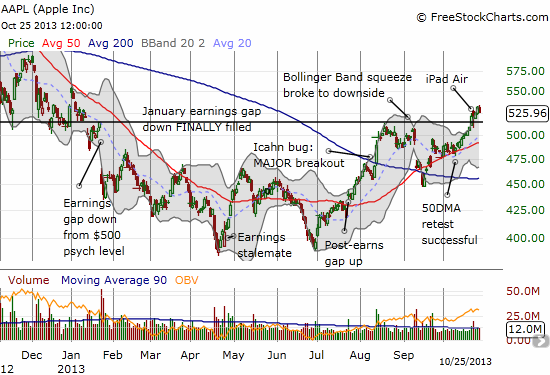

It is that time again – Apple (AAPL) announces its latest earnings on October 28th. This post is another edition of my pre-earnings technical analyses that examines historical data to project the outcome for trading the day following earnings. The short story is that while I remain convinced that AAPL has turned bullish again, the outlook for the one-day post-earnings reaction is pointing downward. The good news is that traders who missed Apple’s latest run may get an opportunity to join the ride at a small discount.

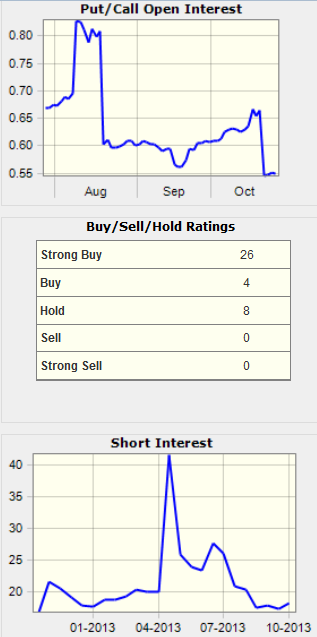

First of all, sentiment going into AAPL’s earnings is extremely bullish no matter where or how I look. The following stats are from Schaeffer’s Investment Research…

The put/call open interest ratio is at its lowest point for AAPL in about the last 6 months. The ratio plummeted from 0.66 on 10/18 to 0.54 on 10/19. AAPL has continued to rally from there in a reversal of the earlier relationship where a rise in put buying seemed to help drive the stock higher.

Analysts are very bullish. I am a bit surprised to see 68% of analysts rate AAPL a strong buy and only 21% are at a neutral; none have sell ratings. The data from Yahoo!Finance indicates a slightly less bullish crowd. (I am still not sure why the analyst rating data can be so different; it must depend on who is considered an “analyst”.) Regardless, this bullishness means that the stock cannot get boosted post-earnings by many upgrades. Hikes in price targets are not as meaningful as analysts whose fundamental opinions change with an upgrade.

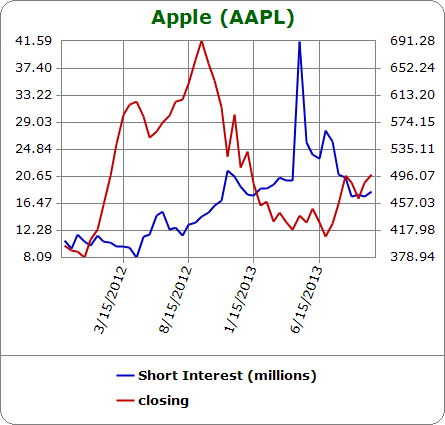

Short interest has never been high on AAPL relative to the float. Short interest is currently 1.9% of float. Shares short are bouncing along their lowest point of the year after spiking tremendously to 41.6M shares at the end of April in the wake of April earnings. Looking back, that episode looks like a climax in bearishness that confirms my early May call for an Apple bottom.

Source: Schaeffer’s Investment Research

So, the current technical setup points to the potential for an excess in bullishness which is rarely good for post-earnings reactions. This sentiment suggests that expectations are finally high again for AAPL earnings. AAPL has a high hurdle to jump to impress traders enough to generate incremental buying in the wake of earnings; I hope those iPhone 5S sales are even better than I think they are! (Still waiting for mine).

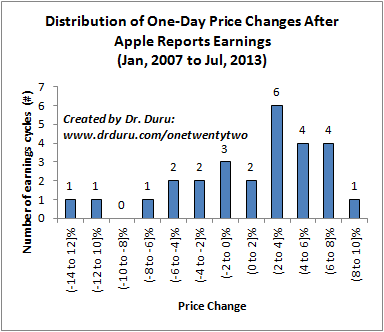

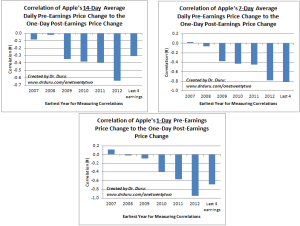

The recent history of trading around earnings adds to the high odds of a post-earnings pullback. The price data in the charts below come from Yahoo Finance.

First of all, note that predicting a post-earnings pullback cuts against the grain of AAPL history since 2007. HOWEVER, the 5.1% gain post-July earnings broke an unusual 4-earnings losing streak.

(Jan, 2007 to Jul, 2013)

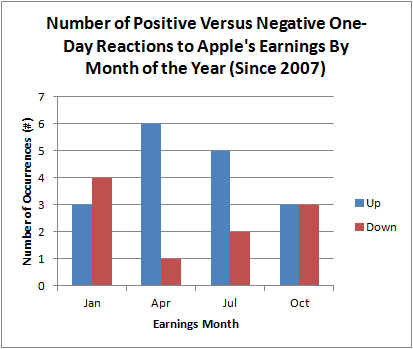

The reaction to October earnings in the past is evenly split between up and down trading.

Sometimes, the trading going into earnings is indicative of the market’s expectations for earnings. The relationship is often hard to assess. In 2012, in general, the relationship was clear for both the 1, 7 and 14 days ahead of earnings. Over the last 4 earnings, only the last 7 days has been meaningful: a strong inverse relationship exists. As of this writing, AAPL’s average daily performance in the past 7 trading days is 0.2%, suggesting a down day for the 29th.

Click the image for a larger view…

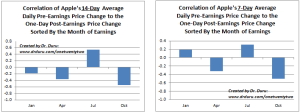

When broken out by the month for earnings, the correlations are strongest for October. They are still not strong enough to draw a tradeable conclusion.

Click the image for a larger view…

So what are the implications for trading out of this downward bias for post-earnings? Since none of these data say anything past the first day, my assessment is definitely NOT a call to turn bearish. Instead, it is a very opportunistic call. It makes sense to me to take advantage of pre-earnings premiums in options to sell calls against existing positions. That disqualifies me right away since my position is not nearly large enough.

I think buying puts are dicey because of the same premiums. The weekly $500 put expiring this coming Friday costs $6.25/6.55. Traders would need AAPL to drop 6.2% just to break even. While AAPL did crater double-digits after January earnings, large post-earnings drops are rare for AAPL (see the chart above). A put spread is a decent low risk/low reward alternative that essentially eliminates the price of the pre-earnings premium (you buy premium on the long side of the spread and sell premium on the short side). If AAPL dips 3% to $510 after earnings, a $515/$510 put spread could roughly double your money.

While the put spread is tempting, I am likely to stand on the sidelines on this one. I will try to be nimble in the wake of earnings. I will either look for a reason to buy call options in the wake of a dip, or I will look for a reason to fade a post-earnings pop. Either way, these trades will be short-term. I will do my best to post on twitter what I decide to do.

(Note that the post-earnings trading analysis trumps the findings of the Apple Trading Model since it does NOT include earnings reactions as a variable).

Good luck to all and be careful out there!

Source: FreeStockCharts.com

Full disclosure: long AAPL