(This is an excerpt from an article I originally published on Seeking Alpha on October 20, 2013. Click here to read the entire piece.)

Homebuilders KB Home (KBH) and Lennar Corp. (LEN) both reported earnings on September 24th. I believe these were the first earnings reports for homebuilders after the Federal Reserve backed down from bond tapering in the face of higher rates, fiscal battles that appeared likely to undermine the economy, and a weaker forecast for economic growth. {snip}

Both KBH and LEN provided some elements of relief and a few points to monitor closely. They both recorded another quarter of strong year-over-year revenue, earnings, and margin growth, even as they each acknowledged shifts in the marketplace. These shifts have not changed their bullish outlook on the market. Aggressive land acquisition programs remain in place and forecasts for the fourth quarter and 2014 remain strong. As with any bullish outlook, the health of the overall economic recovery remains the largest wildcard although builders like KBH and LEN have aggressively focused their businesses on markets with strong underlying economic fundamentals. Both companies remain good buys if the market sells housing plays further. If the market muddles through October with no calamities, then I expect both stocks to finalize bottoming patterns relatively soon thereafter as the market begins to look forward to a sustained recovery in 2014.

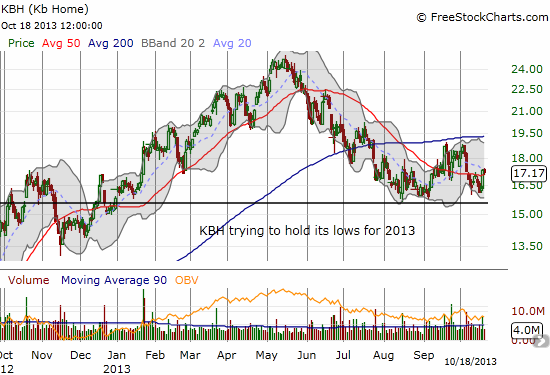

Source for charts: FreeStockCharts.com

{snip} As usual, I was most interested in the commentary and Q&A during the conference call. I have reorganized the transcripts of the conference calls into themes, comparing and contrasting the commentary from each company, and adding my own observations and assessments. {snip}

First, some KBH Milestones…

{snip}

Outlook

{snip}

Strategy (KBH)

{snip}

Housing Recovery

{snip}

Inventory

{snip}

Impact of higher mortgage rates

{snip}

Cancellation rate

{snip}

Credit

{snip}

First-time buyer

{snip}

Land acquisition

{snip}

Costs

{snip}

(This is an excerpt from an article I originally published on Seeking Alpha on October 20, 2013. Click here to read the entire piece.)

Be careful out there!