(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are posted on twitter using the #120trade hashtag)

T2108 Status: 78.5% (Day #7 overbought)

VIX Status: 13.1 (still close to multi-year lows)

General (Short-term) Trading Call: Short.

Active T2108 periods: Day #84 over 20% (overperiod), Day #7 over 70%

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar)

Commentary

In the last T2108 Update I laid out a plan for playing the current overbought conditions. I discussed the plan for going short for now and switching to a bull if overbought conditions last long enough. The 80% overperiod lasted only one day and created small downside for the S&P 500. It was into that drop that I started my first tranche of SSO puts. I opened a second tranche the following day. I have one last tranche to go if the S&P 500 does not sell-off.

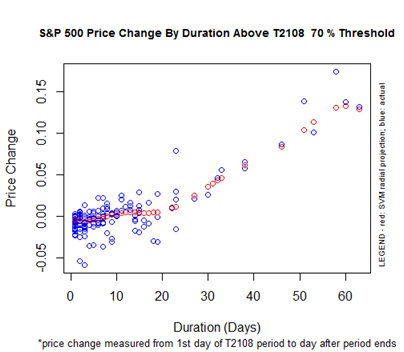

T2108 is now back to the 70% overperiod. It is now 7 days long. It will take 13 days to get to the bullish threshold. In the meantime, a trip above 80% will get me into the third and last tranche which I will make my largest. Notice that with the S&P 500 at all-time highs, the S&P 500 is up 1.5% for the overbought period. This performance is at the top of the range if the overbought period had ended on Friday. This makes for an improved risk/reward ratio for going short here even with the S&P 500 closing at all-time highs.

I will strongly caution that at this point I do not see a strong catalyst for triggering a sharp sell-off. As I noted last week, the fiscal fiddling in the U.S. seems to have exhausted a lot of bearish energy (and angst). So it does not yet make sense to get aggressive with shorts. In fact, the environment seems downright placid with several high profile tech names producing blockbuster responses to their earnings. If T2108 does cross the threshold and signal an extended overbought rally, I will respond with a large tranche of SSO calls. I hope at that time the SSO puts can still provide a realistic hedge.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long SSO puts