(This is an excerpt from an article I originally published on Seeking Alpha on September 26, 2013. Click here to read the entire piece.)

It has been a week since the Federal Reserve surprised the globe when it backed off from its earlier tough talk about bond tapering. The U.S. dollar index (UUP) plunged in response but it has yet to follow-through on that selling:

This was a case where the market seems to have guessed correctly about the likelihood of tapering. {snip}

I am still bullish in the short/intermediate-term for the U.S. dollar. I expect that in due time the U.S. dollar index will trade back to the top of the current range. However, as I searched and reached for reasons to continue justifying this stance, it occurred to me that the forex market in general has been surprisingly listless since the Fed meeting compared to the immediate post-Fed response. It as if markets are coiling in preparation for the next big move. It is hard to tell whether the forex markets will treat a U.S. budgetary impasse as dollar-good (a “safe haven”) or dollar-bad (relative downgrade in economic prospects). At times like these, I like to remove my chips and watch, listen, and learn.

Here are the biases I currently maintain as I wait for the next tradable entry points and/or catalysts.

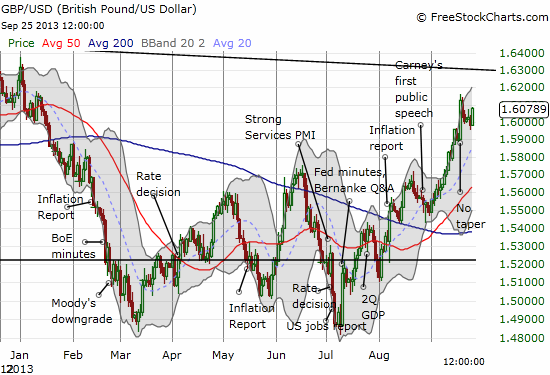

British pound (FXB)

{snip}

{snip}

Euro (FXE)

{snip}

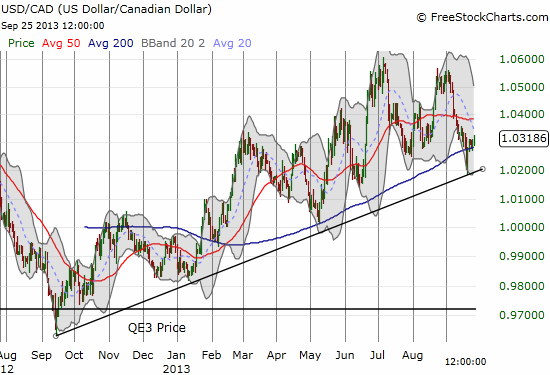

The Canadian dollar (FXC)

{snip}

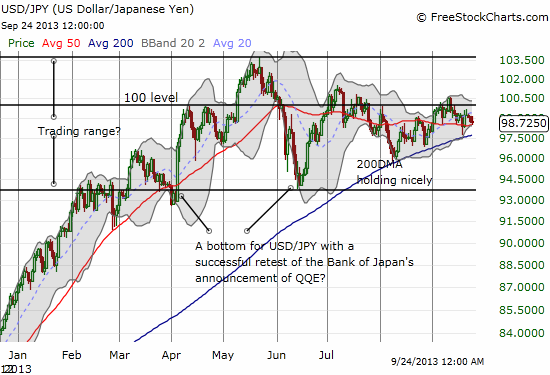

Japanese yen (FXY)

{snip}

{snip}

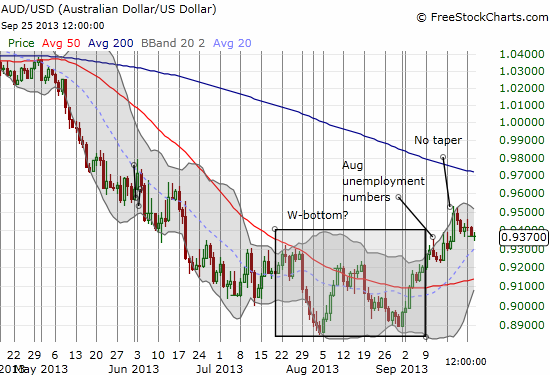

Australian dollar (AUD/USD)

{snip}

Swiss Franc (FXF)

{snip}

Source: All charts from FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 26, 2013. Click here to read the entire piece.)

Full disclosure: no positions