(This is an excerpt from an article I originally published on Seeking Alpha on August 28, 2013. Click here to read the entire piece.)

The S&P 500 (SPY) lost 1.6% on Tuesday (August 27th) as follow-through selling from the previous day overtook the index. Rising tensions between the U.S. and Syria are providing the catalyst for the breakdown in the S&P 500. The U.S. dollar has typically served as a refuge and a “safety currency” during times of geo-political tensions and crisis. Not quite this time it seems. I was quite surprised to see the dollar index (UUP) close down on the day. It was marginal but still notable.

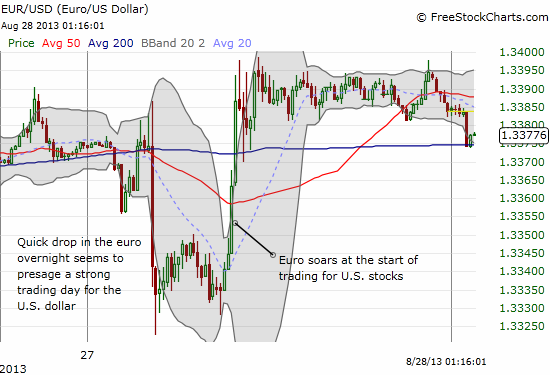

The intraday reversal can be seen in the way the euro (FXE) responded after the opening of trading in U.S. stocks. The euro is about 58% of the U.S. dollar index.

Source: FreeStockCharts.com

Within minutes, the trade ended as quickly as it began, but it still caught my attention.

{snip}

The change in relationship is noticeable in 2013. {snip}

{snip}

Since the S&P 500 has rarely sold off in magnitude this year, the idea of the dollar losing its “risk appeal” has yet to be fully tested. However, I think the signs are there… {snip}

This changing behavior in currencies on large down days in stocks is also of interest because it demonstrates that, much to my surprise, the euro continues to gain favor ever so slowly. I do not think this grace period will last… {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on August 28, 2013. Click here to read the entire piece.)

Full disclosure: net long the U.S. dollar, short the Japanese yen, and short the euro