(This is an excerpt from an article I originally published on Seeking Alpha on May 6, 2013. Click here to read the entire piece.)

1965 to 1967

1969 to 1971

1981 to 1984

1998 to 2000

2010 to 2012

Since 1950, these are the ONLY years where the S&P 500 (SPY) finished the month of May with a loss for at least three years in a row. {snip}

As I demonstrated in a piece two years ago, May, and the subsequent summer, generate so much fear not because of average losses – in fact, the average performance is a GAIN – but because of volatility which can generate some particularly steep losses.

{snip}

The clear lesson was a reminder that May and the summer are about downside risks, not average performance. So, with three straight years of negative months of May behind us, this May is not likely to hurt. However, just in case, there are plenty of hedges…{snip}

ProShares UltraShort MSCI Europe (EPV)

{snip}

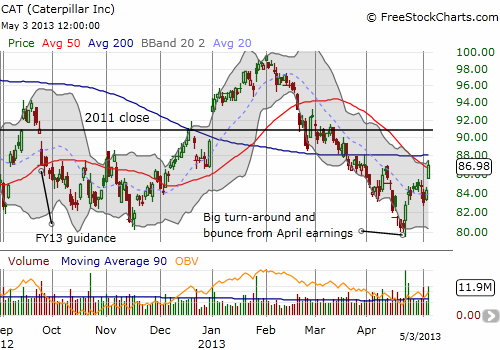

Caterpillar (CAT)

{snip}

Ranger Equity Bear ETF (HDGE)

{snip}

Source for charts: FreeStockCharts.com

So, to review, May is not likely to cause pain this year if we stick strictly to the odds. But if it does, there are plenty of options for hedging bets that may even outperform the obvious hedges of shorting the S&P 500 or buying ProShares UltraShort S&P500 (SDS). None of these options is long-term in nature, and I would recommend eventually plowing any profits into buying the dips this summer.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on May 6, 2013. Click here to read the entire piece.)

Full disclosure: long CAT, short EUR/USD, long EPV, long HDGE