(This is an excerpt from an article I originally published on Seeking Alpha on June 18, 2013. Click here to read the entire piece.)

“There is something you should know about me, about inception. An idea is alike a virus, resilient. Highly contagious. The smallest seed of an idea can grow. It can further define or destroy you.” – Leonardo DiCaprio’s character Cobb in “Inception“

On June 13, 2013, Sayuri Shirai, Member of the Policy Board for the Bank of Japan (BoJ), delivered an extensive speech to business leaders in Asahikawa on monetary policy titled “Japan’s Economic Activity, Prices, and Monetary Policy: Monetary Policy in the Past and Present.” For me, this speech was very revealing, informative, and enlightening. I was particularly intrigued by Shirai’s discussion of what is essentially the psychological aspect of implementing monetary policy, where inflation expectations clash with the incentives for saving versus investing versus consuming. Shirai makes it clear this psychology forms the foundation of an anti-deflationary monetary policy.

Shirai describes four main aspects of the aggressive monetary policy called Quantitative and Qualitative Monetary Easing (QQE):

- Increase in Purchases of Japanese Government Bonds (JGBs) and Extension of Their Maturities

- Increase in Purchases of Risk Assets

- Emphasis on Inflation Expectations and Adopting the “Quantity” Target

- Effective Communication Strategies

I will focus on Aspects #3 and #4.

For Aspect #3 (emphasis mine):

{snip}

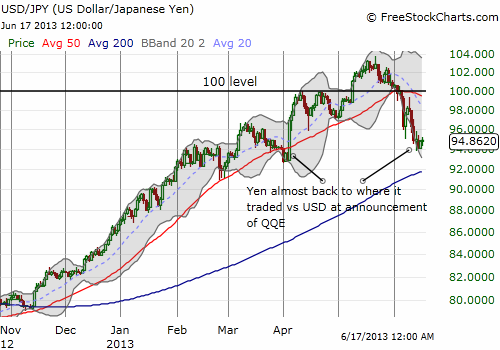

Source: FreeStockCharts.com

{snip}

Shirai explains how previous attempts at inflation targeting were too “passive” and not convincing enough. Under CME, the total amount of asset purchases was large but the piecemeal approach of raising the amount nine times made policy appear passive and ineffective. The BoJ appeared tentative and reluctant. Now, with a concerted effort to go after the hearts and minds of the Japanese with mind over yen, Shirai can confidently proclaim:

“I regard the adoption of the 2 percent target as a major achievement in the history of the Bank’s conduct of monetary policy.”

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on June 18, 2013. Click here to read the entire piece.)

Full disclosure: net short Japanese yen