(This is an excerpt from an article I originally published on Seeking Alpha on July 30, 2013. Click here to read the entire piece.)

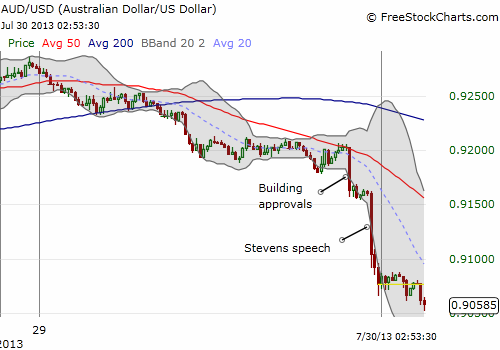

The market is finally listening for every little cue from Glenn Stevens, the Governor of the Reserve Bank of Australia (RBA), and he is taking full advantage of it to help grease the skids for the Australian dollar (FXA).

On July 30th (Australian time), Stevens spoke at The Anika Foundation Luncheon using a speech titled “Economic Policy after the Booms.” Overall, the speech was an important one in providing a broad perspective on the Australian economy and its prospects. I want to focus here on the key components related to the Australian dollar.

Firstly, Stevens made it clear that interest rates are likely to stay low in Australia for quite some time. {snip}

Stevens justifies the low rates further by referencing the global phenomena of risk aversion even as asset prices, in this case natural resources, have soared:

{snip}

These contradicting forces have intrigued me as well. I have interpreted it as evidence of dueling forces in the global economy between deflationists and inflationists acting at the same time. {snip}

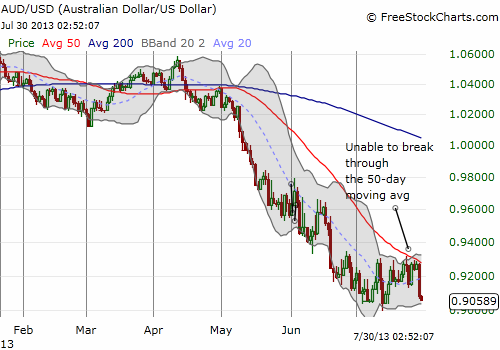

Lower rates also imply a lower Australian dollar, especially given the currency has been so high for so long in the post-recovery period. Stevens notes that the on-going decline is appropriate since a rebalancing of the Australian economy must involve more foreign demand… {snip}

Source: FreeStockCharts.com

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 30, 2013. Click here to read the entire piece.)

Full disclosure: net short Australian dollar, net long British pound