(This is an excerpt from an article I originally published on Seeking Alpha on August 5, 2013. Click here to read the entire piece.)

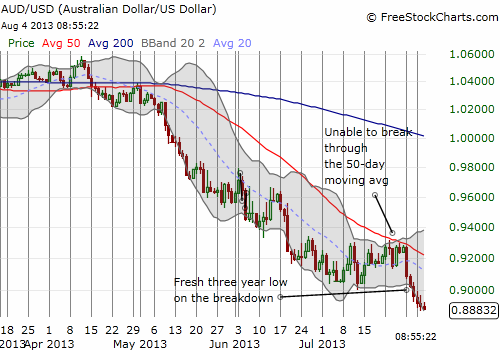

After Reserve Bank of Australia (RBA) Governor Glenn Stevens made it clear on July 30, 2013 that the RBA will maintain exceptionally low interest rates for quite some time, the Australian dollar (FXA) broke to fresh 3-year lows against the U.S. dollar. The RBA Rate Indicator showing the odds of a rate cut to 2.50% in Tuesday’s RBA decision on monetary policy soared from 79% to 91%. {snip}

{snip}

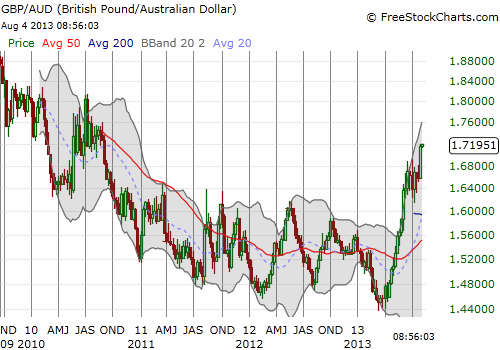

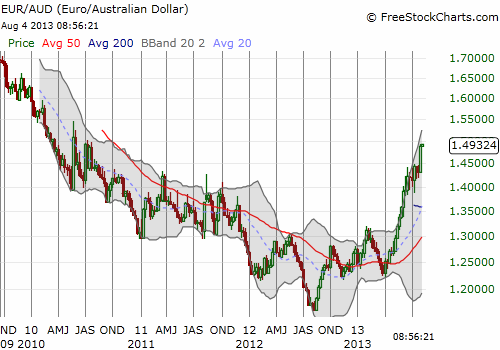

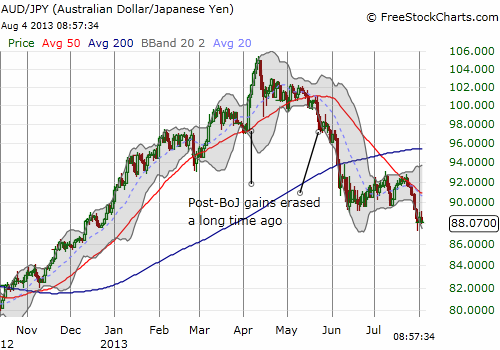

Source for charts: FreeStockCharts.com

{snip}

With this pervasive weakness and near-certainty of a rate cut, it seems to me that conditions are ripe for a relief rally. {snip}

The relief rally I am expecting is one that features a dissipation of catalysts for selling. For example, the Australian stock market (EWA) is finally responding again to the beating of the Australian dollar. It rallied throughout July with the rally accelerating somewhat after Stevens’s speech.

Source: Australian stock exchange (ASX)

With the market anticipating better days ahead again, at some point the currency will have to at least stabilize to represent the improved economic prospects.

More importantly, I cannot imagine the RBA will be able to credibly craft a statement that suggests rates will go even lower. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on August 5, 2013. Click here to read the entire piece.)

Full disclosure: net long Australian dollar, long USD/JPY