(This is an excerpt from an article I originally published on Seeking Alpha on June 6, 2013. Click here to read the entire piece.)

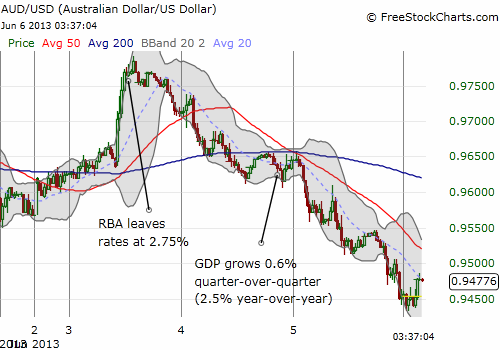

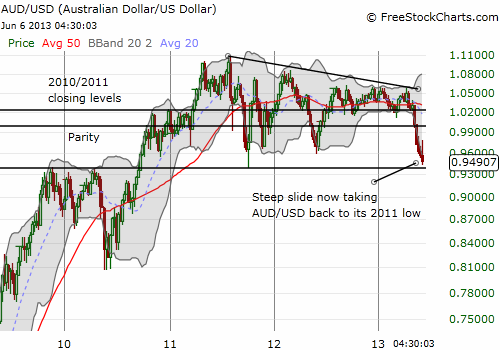

On Monday night (June 4th, Tuesday morning in Australia), the Reserve Bank of Australia (RBA) decided to leave its cash rate steady at 2.75%. The statement contained no new news and no surprises, but the RBA’s commentary on the currency spoke volumes:

“The exchange rate has depreciated since the previous Board meeting, although, as the Board has noted for some time, it remains high considering the decline in export prices that has taken place over the past year and a half.”

Combined with the reiteration of inflation providing scope to lower rates further if needed, the RBA in essence encouraged traders to continue selling the Australian dollar (FXA) lower. {snip}

{snip}

…as I read commentary about the GDP report from Tim Colebatch in the Sydney Morning Herald, it is clear that Australians have high expectations for their collective economic performance. Colebatch found the following numbers behind the GCP report “startling”:

{snip}

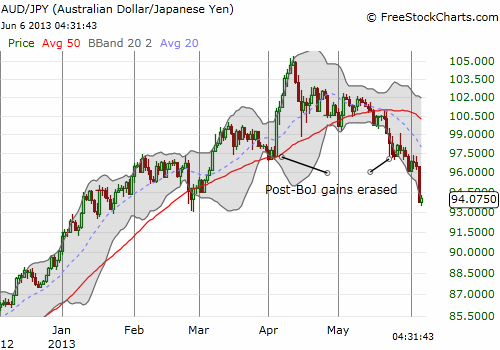

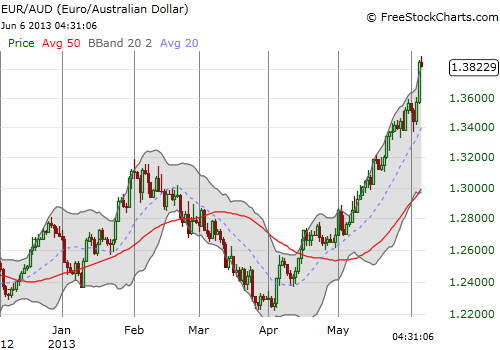

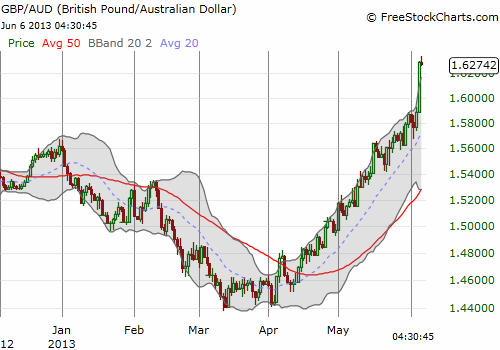

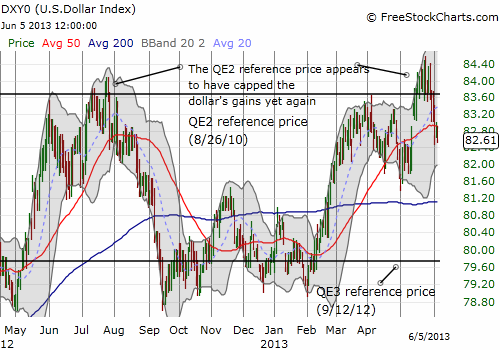

{snip} The charts below compare the Australian dollar to other major currencies to make it clear how broad-based the recent weakness is:

{snip}

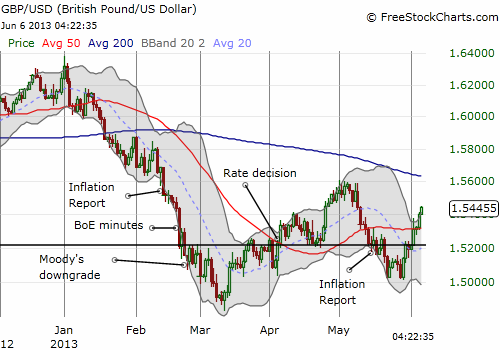

As traders cast about for alternative forex leaders, they seem to have warmed up again to the British pound (FXB).{snip}

Source for charts: FreeStockCharts.com

I remain bullish on the British pound (see “The British Pound Is A Bargain“), but I sold the bulk of my position (announced as usual in my twitter feed with the #120trade hashtag) into the recent strength because it seems that traders are rotating and fishing around for the next “safe” currency. {snip}

The charts above show a trading theme that seems quite stretched, like a looming crescendo. It is not easy to tell when the final rushed exit will occur. Expectations are now rising for an RBA rate cut in July. The current weakness is likely accentuated by these expectations, making it likely a rate cut will be fully priced in well ahead of the July RBA meeting. U.S. economic headlines also add further uncertainty and volatility in the outlook.

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on June 6, 2013. Click here to read the entire piece.)

Full disclosure: net short Australian dollar