(This is an excerpt from an article I originally published on Seeking Alpha on June 11, 2013. Click here to read the entire piece.)

The Port Hedland Port Authority along the northern coast of Western Australia reported on June 10th surprising news on an iron ore shipment:

{snip}

The Port does not report the value of the cargo, so we might have at least two interpretations – one from the demand perspective and one from the supply perspective… {snip}

Supporting the demand perspective for explaining this large shipment is a recent Reuters story reporting the large amount of iron ore exported from Australia to China in May while prices were tumbling:

{snip}

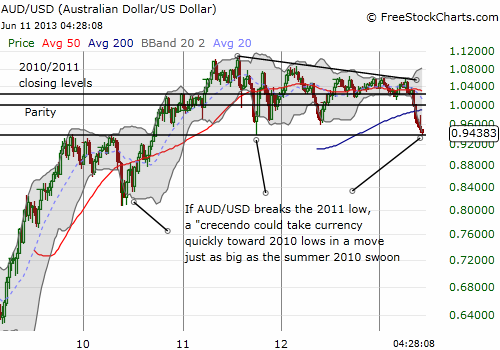

Meanwhile, the plunging Australian dollar (FXA) is making Australian iron ore even cheaper by the day.

Source: FreeStockCharts.com

I earlier argued that the Australian dollar is reaching some kind of crescendo. It seems even clearer now that the timing of that final washout in the currency will be a complex interplay between expectations for another RBA rate cut in July; Chinese steel production, steel prices; and iron ore prices, inventories, and shipments. With so many related extreme movements and levels happening at once, the crescendo should prove quite sharp and abrupt. This move could prove particularly painful if iron ore restocking somehow ends before prices begin a recovery.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on June 11, 2013. Click here to read the entire piece.)

Full disclosure: net short the Australian dollar