(This is an excerpt from an article I originally published on Seeking Alpha on April 12, 2013. Click here to read the entire piece.)

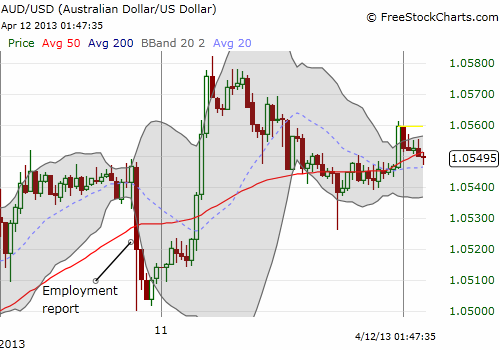

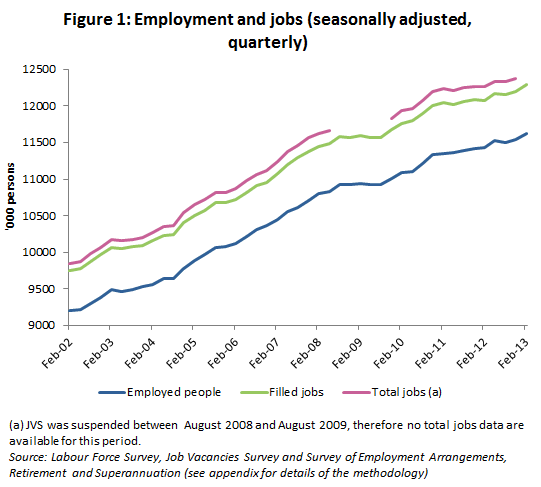

Last week, we learned that the Australian trade balance for February was much better than expected, -178M AUD versus expectations for -1B AUD and -1.2B AUD for January. Additionally, retail sales continued their surge by gaining 1.3% month-over-month versus an expectation of just 0.3% (reference dailyfx.com calendar). On Wednesday evening, Australia reported a particularly poor jobs number. The unemployment rate ticked up to 5.6% from 5.4% where consensus thought it would stay. The economy lost 36,100 jobs against an expectation for a loss of 7,500. Last month’s report showed an increase in jobs by 74K.

{snip}

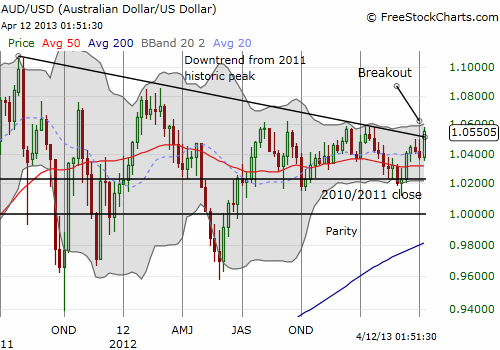

The net result is that the poor employment report only slowed down the Australian dollar’s breakout from a downtrend that has lasted since the currency’s peak in 2011.

Source for charts: FreeStockCharts.com

One could easily argue that the Australian dollar still has plenty of overhead resistance from clear obstacles like the highs from January and the highs from February, 2012. {snip}

{snip}

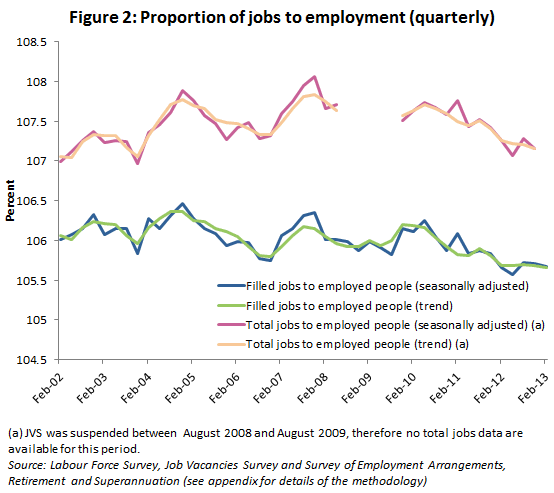

Australia even has a ratio of total jobs to employed people greater than 1 although the related ratios are at multi-year lows.

In other words, Australia’s economy is still far better off than most industrialized economies. {snip}

Source: Reserve Bank of Australia’s Index of Commodity Prices

I argued earlier that iron ore prices would eventually come down this year and bring the Australian dollar down with it. However, the dynamic of the rapid devaluation of the yen (FXY) is currently providing more than enough buffer against that risk (I have even flipped bullish on Cliff Natural Resources – more on that in another piece). {snip}

The irony of an elevated Australian dollar is that it gives the RBA more breathing room to cut rates. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 12, 2013. Click here to read the entire piece.)

Full disclosure: long AUD/USD