(This is an excerpt from an article I originally published on Seeking Alpha on April 12, 2013. Click here to read the entire piece.)

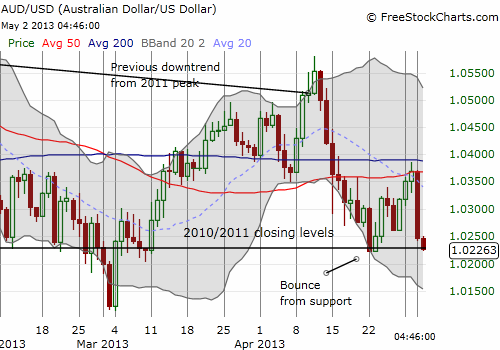

Next week on May 6th (May 7th in Australia), the Reserve Bank of Australia (RBA) will make its next monetary policy decision. The Australian dollar has shown marked weakness going into this decision. This behavior has forced me to shift into neutral on the Australian dollar just one month after finally becoming bullish again.

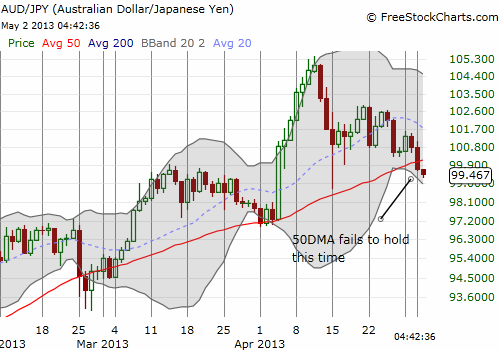

I have been particularly disappointed in the performance of the Australian dollar given the context of a rapidly devaluing yen (FXY). One part of my fundamental assumption was that the on-going stubborn strength of the Australian dollar would make the currency very attractive to carry traders and others selling/borrowing yen to purchase higher-yielding assets abroad.

{snip}

Source: FreeStockCharts.com

{snip}

Two things are likely weighing on the Australian dollar now: 1) a growing expectation for a rate cut, and 2) relatively weak iron ore prices (iron ore is Australia’s biggest export by far).

{snip}

In other words, expect continued volatility. An all-out crash similar to the one in August, of last year does not seem likely, but the current weakness likely has traders a bit more nervous than usual.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 12, 2013. Click here to read the entire piece.)

Full disclosure: long VALE, long Australian dollar