(This is an excerpt from an article I originally published on Seeking Alpha on February 19, 2012. Click here to read the entire piece.)

{snip}

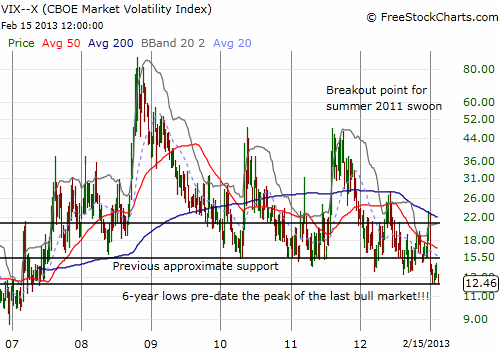

Nassim Taleb has been on a tour promoting his new book “Antifragile: Things That Gain from Disorder.” He provides related links and interviews on his Antifragile web site where he emphasizes the point that governments and regulators should not strive to drive out volatility from the financial markets in an effort to make markets appear “safe.” Taleb considers volatility a tool for failing quickly, learning fast, and building robustness. I listened/watched his talks for a second time this weekend in honor of the volatility index, the VIX, which has amazingly dropped to seven year lows.

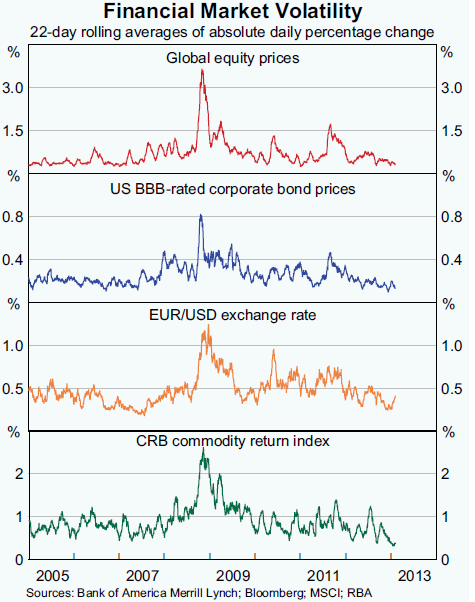

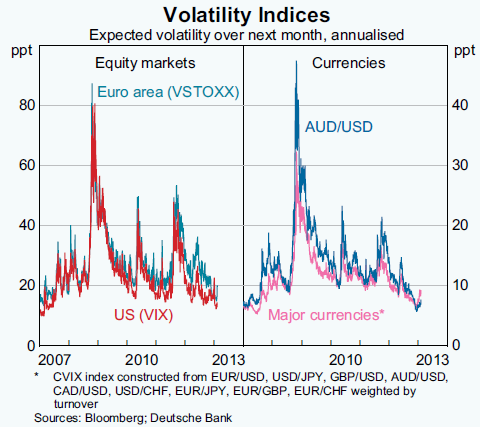

Volatility has not only declined precipitously in U.S. markets. This dynamic is global. The latest Statement on Monetary Policy from the Reserve Bank of Australia (RBA) earlier this month contains some very instructive graphs on the worldwide, nearly synchronized, decline in volatility.

{snip}

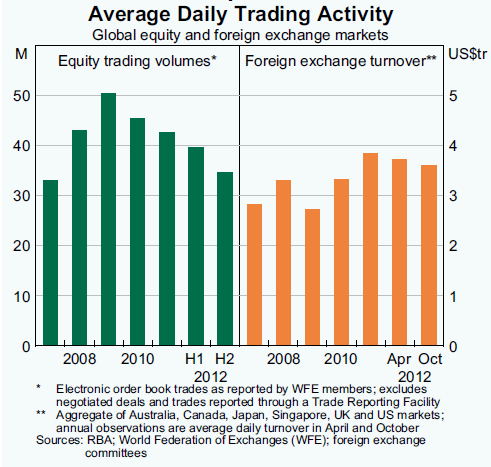

The RBA points to actions by the European Central Bank (ECB) and the Federal Reserve as primary contributors to driving down stock market volatility (and trading) in 2012:

{snip}

Even more notable is that the RBA points to currency interventions as an explanation for the recent decline in volatility in foreign exchange markets.

{snip}

The interesting and contrary irony here is that we could consider the stock market, especially now, to be LESS safe, specifically because volatility is so eerily calm. {snip}

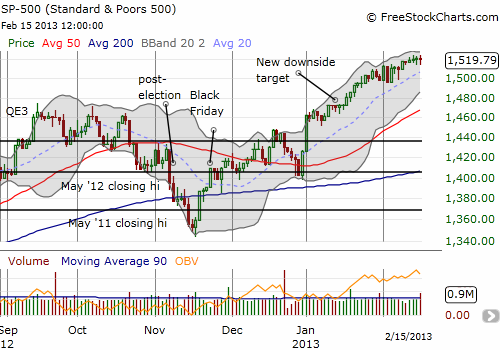

Currently, the “Black Friday trade” remains firmly grounded in bullish mode, but I am definitely not one to interpret the relative calm as a sign that the water is just now getting safe for swimming. Dips are buyable because some amount of downside risk drops from the table. The same holds true now for me. Market technicians have a truism that I hold dear in times like these: periods of extremely low volatility precede periods of high volatility. We may not know what will stoke the flames only that the flames WILL eventually get stoked somehow, someway.

Be careful out there!

Full disclosure: long VXX shares and puts

(This is an excerpt from an article I originally published on Seeking Alpha on February 19, 2012. Click here to read the entire piece.)

Hi there, long time lurker, I always appreciate your analysis. Interesting idea there, long VXX shares and puts. I’m not sure I understand the thinking there, I’m new to trading and am basically just beginning to understand pairs. Is the idea with that trade that you get to keep the premium and the appreciation in shares will balance out the appreciation in puts? Or, what is your balance between shares and puts?

Thanks for throwing in the feedback longtime lurker! 🙂

So, the idea for the VXX shares and puts combo is actually mostly a bet that VXX will continue its death spiral into perpetuity…yet, every now and then, volatile times will surely erupt where VXX shares skyrocket. While I have mainly focused on timing the buy and sell of puts, at some point, I imagine I will try to tweak the holding of shares too. For example, when I bought those SSO puts, I should have also purchased a few more VXX shares for good measure. On the flip side, I neglected to ADD to my puts when VXX popped.

The idea for now is that I should always have enough puts on to at least cover the short-term decline in VXX. You use delta for that. I currently own the March $21 puts with a delta of .29 at Friday’s close (delta measures the approximate and expected change in value of the option for every $1 change in stock price “close to” the strike of the option). To be balanced, I need to own 29 shares of VXX for every 1 put I own. Thanks to neglecting to add to the position when VXX popped, my ratio is currently a little out of whack at 1.29 (# of VXX shares divided by 100*Delta). The ratio should be tuned for the presumed bull/bear bias. I have been light on the puts given the market was overbought.

I hope that helps.

Excellent stuff. I’m grateful for the knowledge you pass on and will o course continue to lurk! Good luck!

Thanks for your support! I noted in my last T2108 Update that I have put on my list to (one day) write something that formalizes the VXX share/put strategy.