(This is an excerpt from an article I originally published on Seeking Alpha on November 28, 2012. Click here to read the entire piece.)

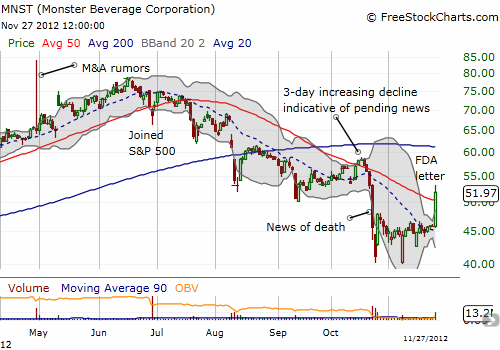

On October 25th, I noted how intrepid traders had loaded up on November $45 puts ahead of news that Monster Beverage Corporation (MNST) was implicated in a lawsuit over the death of a girl who drank Monster Energy Drink right before she died. At the time I wrote, MNST had spiked almost 17% after the company defended itself in a press release. I declared the trade in the November $45 puts to be over. While the stock never traded higher and even retested its intraday lows two weeks later, sure enough, come expiration, MNST closed just above $45 at $45.47. Those November $45 puts expired nearly worthless just as MNST happened to remain stuck for almost three weeks just below its 2011 closing price of $46.25.

My assertion at the time was grounded in the belief that trades based on advanced knowledge (or presumed knowledge) of negative news releases are setup to take advantage of the near certain quick trigger, emotional trading that will send market participants selling first and asking questions later. That kind of fear usually has a short shelf life. Tuesday’s 13% spike higher is yet one more, I daresay inevitable, phase in the relief of that fear.

{snip}

Source: FreeStockCharts.com

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on November 28, 2012. Click here to read the entire piece.)

Full disclosure: long SSO shares