(This is an excerpt from an article I originally published on Seeking Alpha on December 3, 2012. Click here to read the entire piece.)

I was absolutely fascinated by a recent Seeking Alpha piece titled “The Surprising Truth Behind Herbalife Put Volume.” It is a revealing treatise and a cautionary reminder of why traders must not jump to quick conclusions in interpreting large options trades. In the case of Herbalife (HLF), author Richard Pearson explains how large volumes of puts traded were likely executed by a trader interested in hedging a large short position, similar to the way that an investor might sell covered calls. When other traders rush in to buy options in the hopes of riding coattails, they further drive up implied volatility which in turn provides richer premiums for selling these same options. (I covered how fear-driven put volume that follows the trades of people with advanced knowledge/insight has a very short shelf life in “Monster Spike On Mild FDA Letter Setup By Previous Fear-Based Trading“). A $2.0M purchase of shares by HLF COO Richard Goudis has greatly increased the stakes for shorts – who are now 17% of HLF’s float – and will perhaps motivate even more hedging, if not an outright short squeeze.

{snip}

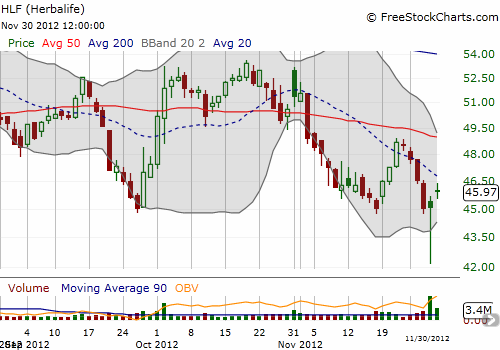

All things considered, I am inclined to take a bullish bias on HLF. {snip}

Source for charts: FreeStockCharts.com

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 3, 2012. Click here to read the entire piece.)

Full disclosure: no positions

So Dr Duru is there a feasible way to track both extremely high short interest together with extreme high put/call readings as you alluded from Schaeffer’s put/call OI chart in order to detect such an outlier event?

i would pay for such a service.

Reason for the high put buys is SEC wont even try to chase inside activity in options market. Just think who many shares you can control for $5000 you can have crazy aunt Mary open an account along with others who arent tied with insider stuff. been going on for 20 yrs in bio tech. Recall FDA insiders and doctors jumping on this and it still persists big time.

Anyway, my point is the high readings which we normally look at as contrary indicators, ie extreme bearish/bullish can be effective short term trading you will notice on your put/call chart going back just a year never once did HLF p/c reach near the highs it did but if you only look at a 6 months p/c chart you wouldnt have known this.

It was clearly an outlier event where the p/c and high interest became leading indicator.

Also note on major market turns like in 2000, 2008 you will see this same activity exactly.

I do not know of such a service although Schaeffer’s provides a daily list of what should be outlier options activity. And as you know you can go to a myriad of other sites to get lists of the top shorted stocks. Sounds like you have chanced upon a business opportunity? Or perhaps on a weekly basis it makes sense to check both lists and cross-reference. I will add this to my list of to-dos.

I seem to recall the SEC pursuing a few cases several years ago where people with insider information traded on options. I think in those cases, the trading was very “obvious.” Massive amounts of money spent, making the activity stick out like a sore thumb. Involved regular “Ma and Pa” types who chanced upon some inside info and tried to disguise activity by trading from Eastern Europe I believe.

Regardless, yes, I am sure it is quite difficult for the SEC to gather enough evidence on insider trading period, not to mention in options trading. Especially once momentum builds and you get traders following each other, it is even harder to distinguish insider trading from momentum trading.