(This is an excerpt from an article I originally published on Seeking Alpha on December 6, 2012. Click here to read the entire piece.)

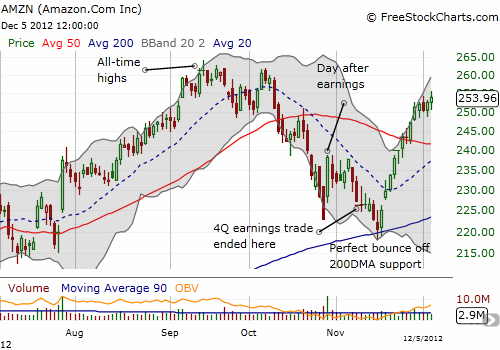

The Amazon.com post-earnings trade ended down for this final quarter of the year. It was a rare miss that included some important moves in the stock. The chart below shows the highlights:

Source: FreeStockCharts.com

{snip}

Amazon’s resilience continues to confound me, and, I am guessing, continues to frustrate bears. However, as TheStreet.com columnist Rocco Pendola notes in “Short Amazon: Do You Have the Guts?,” there are actually few shorts open on AMZN. Shares short are currently just 2.3% of the float. This short interest is down 25% from the last peak of short interest in mid-May. The open interest put/call ratio is well off extremes seen over the past two years. Implied volatility is just about as low as it has been over the past two years as well. In other words, very few people are betting on a decline in AMZN even as the stock nears another all-time high.

As Pendola suggests, it is as if even the (remaining) shorts are bullish on the stock: “I bet plenty of those short shares are held by big money folks who are net long Amazon.”

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 6, 2012. Click here to read the entire piece.)

Full disclosure: no positions