(This is an excerpt from an article I originally published on Seeking Alpha on October 1, 2012. Click here to read the entire piece.)

The major paper currencies have an on-going problem – many of the financial authorities in charge of preserving their “value” are actively trying to drive that value downward, jawboning for a decline, and/or wishing beyond hope for a decline. Currencies are an active component of economic recovery programs and likely will remain so until the global economy returns to trend growth. As a result, very few trends have emerged in the major currencies since the financial crisis as traders have bounced from one momentary theme to the next.

{snip}

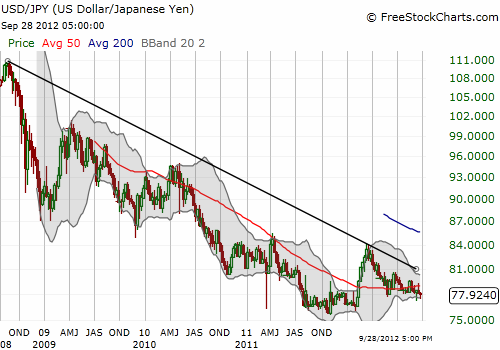

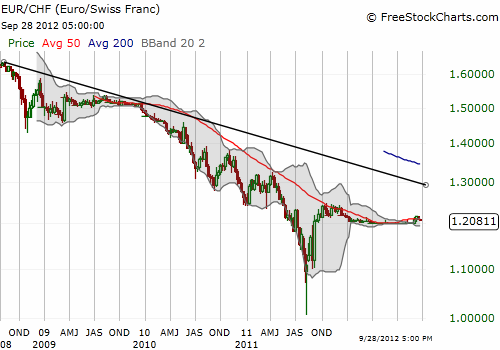

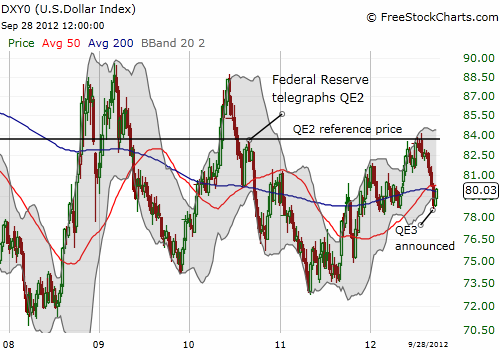

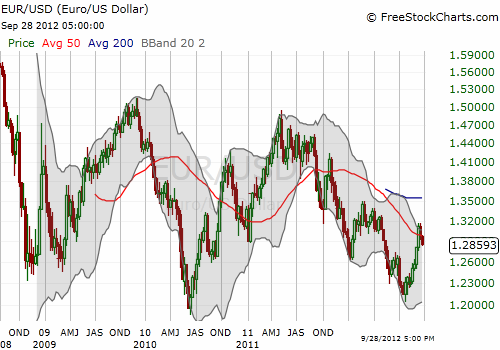

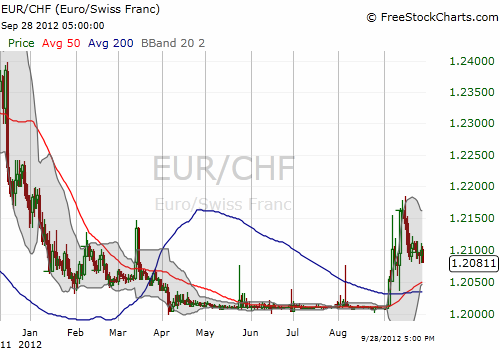

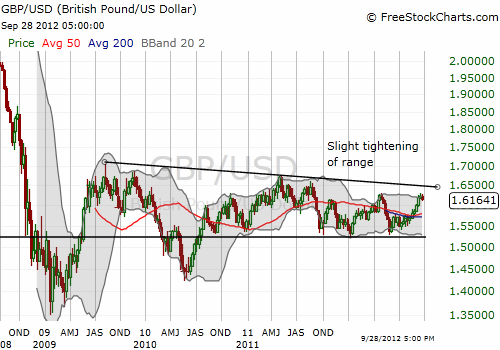

Here are the trends using representative currency pairs – the solid black lines define the overall trend from late 2008.

Source for these and all other charts except where otherwise noted: FreeStockCharts.com

This landscape produces a lot of landmines for currency traders looking for reasons to maintain bullish positions on any currency. I provide this backdrop as a reminder that almost no emerging trend in currencies can be expected to last beyond the short-term. On the other side of every long idea is a central bank and/or other assorted authorities who are actively interested in working against that long. In other words, the clock is ticking on almost every trade. Thus, my currency setups to start the fourth quarter must be interpreted as plays for “right now”; most are not long-range forecasts or extended projections.

{snip} The U.S. dollar is a great example of the trendless meandering of most major currencies against each other.

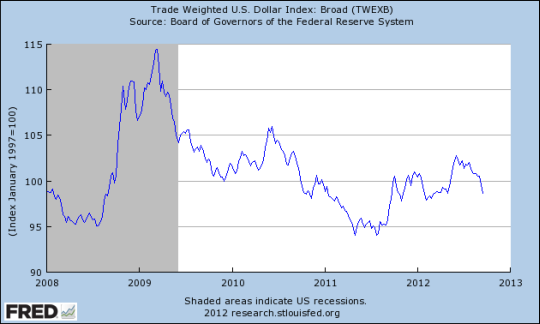

The trade-weighted index has also bounced around without trend with 2011 matching the low from 2008.

Source: Federal Reserve Bank of St. Louis, Economic Research

With this backdrop, here are the setups I am watching to start the fourth quarter:

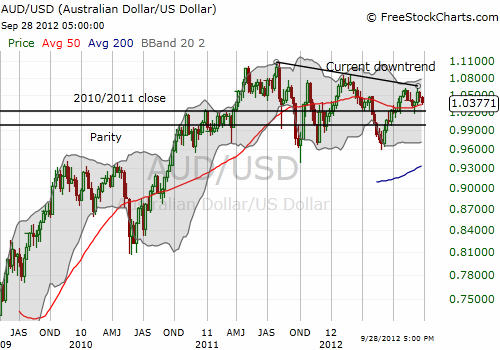

Australian dollar

{snip}

{snip}

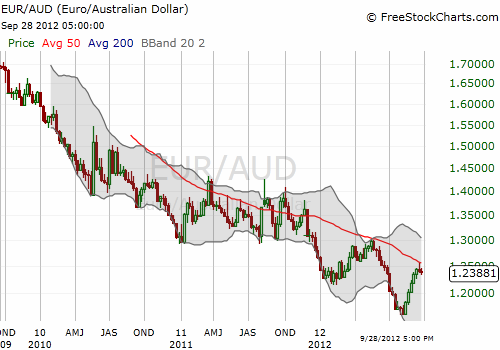

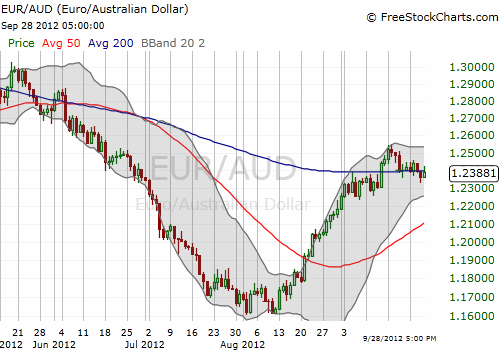

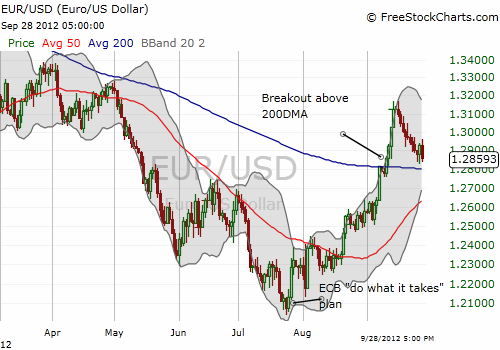

The euro

{snip}

{snip}

{snip}

{snip}

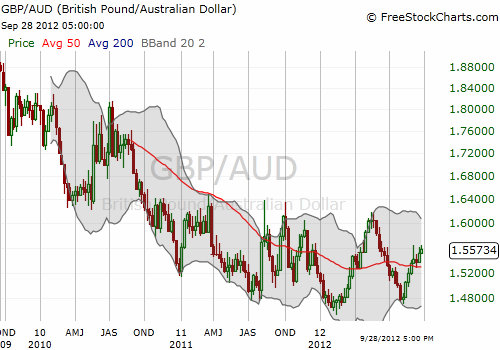

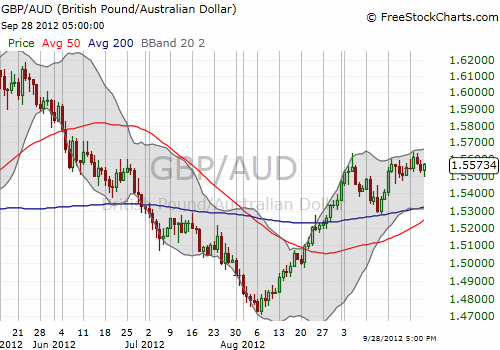

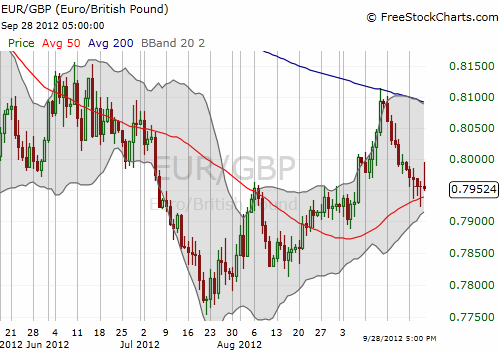

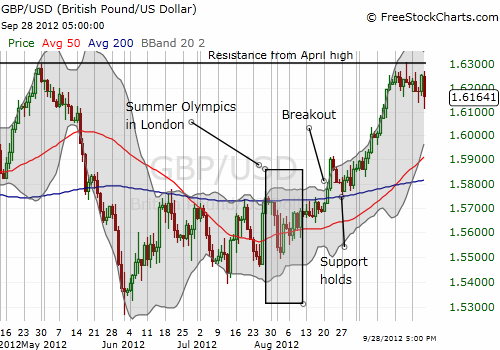

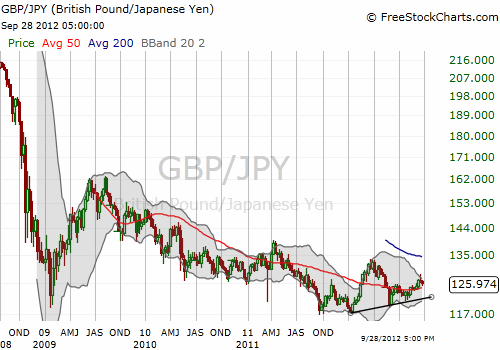

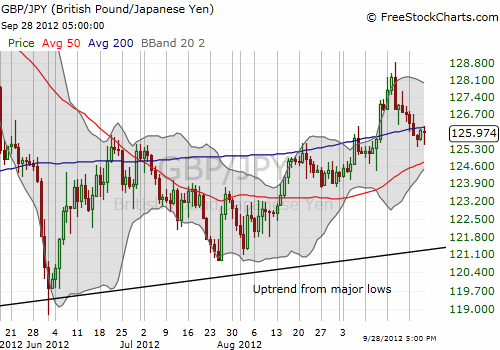

British pound

{snip}

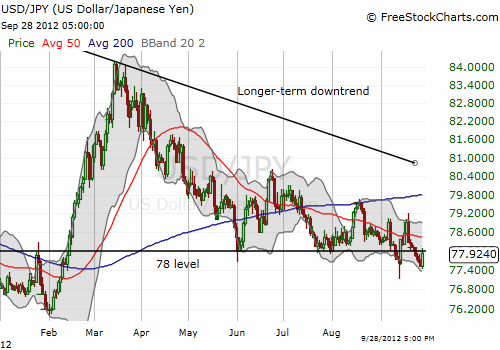

Japanese yen

{snip}

Canadian dollar

{snip}

Summary

I start the fourth quarter with an empty plate looking for trades. I am waiting for the next RBA monetary policy statement to confirm my expectations for Aussie interest rates. I am bullish on the British pound but waiting for a fresh breakout against the U.S. and Australian dollars. I am looking to see whether the euro will hold support against the U.S. dollar. Finally, I am keeping an eye on opportunities to short the Japanese yen.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on October 1, 2012. Click here to read the entire piece.)

Full disclosure: no positions