(This is an excerpt from an article I originally published on Seeking Alpha on September 25, 2012. Click here to read the entire piece.)

After the Reserve Bank of Australia (RBA) released its monetary policy statement on September 4th, I noted how the loudest part of the statement was left unsaid. The RBA raised no significant alarms – a distinct contrast to the loud alarms bells ringing from numerous analysts due to China’s slowing growth rate. The minutes from that meeting filled in most of the holes and certainly confirmed the RBA’s overall sense of calm about the Australian economy. In the world of forex, those minutes are already old news, but I find it worthwhile to review given the additional clarity it brings to likely near-term monetary policy and currency trends.

{snip}

With the Federal Reserve promising to buy assets until U.S. employment improves sufficiently, I think the RBA will feel ever more pressure to rejoin major central banks in the global easing campaign. {snip}

While the RBA feels the Australian dollar is higher than it should be, the current historic terms of trade suggest that the overall strength in the currency is not extreme as some analysts have suggested…{snip}

{snip}

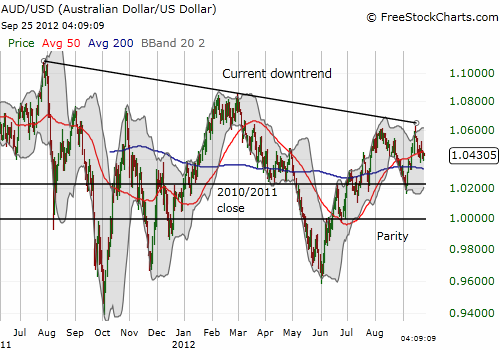

Source: FreeStockCharts.com

Commodities are a large part of the Australian economy – iron ore constituted 20% of exports last year – so the RBA is compelled to discuss current economic/financial conditions in commodity markets. The commentary from the minutes further underscored the RBA’s lack of alarm over the drop in iron ore and coal prices.

{snip}

Taken together all these projections imply that the RBA believes slowing growth rates in China are not going to undermine the Australian economy anytime soon.

{snip}

Unless the RBA is completely off base, I think traders and investors may be surprised through the end of this year by a resilient Australian dollar and monetary policy that is not quite as accommodative as most analysts expect. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 25, 2012. Click here to read the entire piece.)

Full disclosure: short AUD/USD