(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are highly likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are posted on twitter using the #120trade hashtag)

T2108 Status: 81.2% (overbought day #6)

VIX Status: 14.1

General (Short-term) Trading Call: Sell short-term bullish trades (SSO calls under new strategy), otherwise hold.

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar)

Commentary

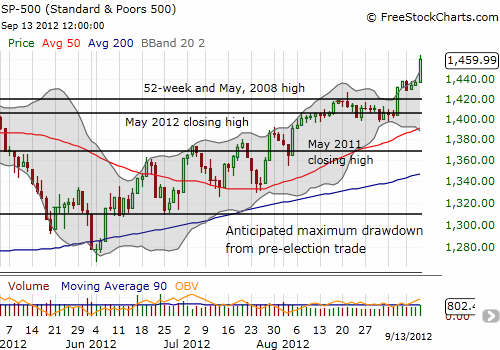

T2108 jumped to two-month highs as a 1.6% rally in the S&P 500 validated the new trading strategy of aggressively buy the dips with SSO calls. The surge also seems to confirm what I expect to be an extended overbought period similar in duration, and perhaps magnitude, to the overbought rally that began the year.

I profitably exited the first trade using this strategy – the bad news is that I closed out far too early with the calls more than doubling from my exit price at the close!

Here is a reminder of the new strategy – all buys refer to SSO calls:

- Intra-day: Buy dips in the morning and sell on next rally.

- Market close: Buy weak closes with target to hold position for 1-3 days.

- Rallies in general: sell rallies but do NOT fade them.

- Stops: The bullish strategy ends on whatever comes first: T2108 drops below 70% (no longer overbought) or the S&P 500 makes a lower low.

The weak close triggering my purchase occurred on Monday, September 10. It was an interesting day. As I prepared to buy the morning’s dip, the market’s decline stalled. I decided the market was not low enough to warrant purchasing SSO calls. I placed a lower limit order and got filled near the close. I purchased weekly calls given the Federal Reserve meeting today. I figured that meeting would make or break this purchase no matter the expiration, so I went the “cheap” route by purchasing weeklies. In the future, I will only purchase weeklies for morning dips. Purchases at the close will be for monthly expirations. I also hope to get more aggressive.

Depending upon how this overbought period unfolds, I may raise the stop point for this new strategy to today’s low. This low marks the beginning of a new era of blank checks from the U.S. Federal Reserve. (I also need to decide what to do with my VXX shares. Selling calls against them and buying puts is on;y carrying me so far!)

The Federal Reserve was of course the main headline for today, but I will save my commentary on the Fed’s actions for another post. I will keep things technical here. (I have posted several articles anticipating further easing by the Federal Reserve. Click here for an archive). I will say that I fully expect the U.S. dollar to bounce back next week after financial markets finish extrapolating endless easing by the Fed and start pricing in a U.S. economy which remains relatively stronger the Europe’s. The Fed’s “blank check” to the markets also increases the urgency for a revisit to the commodity crash portfolio! Stay tuned…

Daily T2108 vs the S&P 500

Click chart for extended view with S&P 500 fully scaled vertically (updated at least once a week)

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long VXX shares, short VXX calls