(This is an excerpt from an article I originally published on Seeking Alpha on September 11, 2012. Click here to read the entire piece.)

Federal Reserve Chairman Ben Bernanke has made the case for further monetary easing simple and straightforward. Unless some miracle happens in the economy to send growth hurtling upward (presidential campaign promises, like Mitt Romney’s pledge to generate 12 million jobs in four years, do not count!), the Fed will act. I am not going to predict how, when, or why, just that monetary easing in some form will happen. I reiterated the case in “Little New News From Jackson Hole But Market Readies For Action Anyway.” I am reading and hearing critics complain that further easing will not accomplish anything, that it will not generate more growth. However, I think these critics are missing the counterfactual that forms the foundation of the Federal Reserve’s bias to act. The Federal Reserve is becoming more afraid of what could happen if it does NOT act: long-term unemployment getting longer and eventually undermining the economy to the point of a new recession. If no additional boost to growth happens post-easing, critics will feel vindicated, but they will be neglecting the counterfactual case for the Fed’s action.

In fact, we KNOW the Federal Reserve does not think it can generate much more economic growth on its own. {snip}

I think fiscal policy is the source of the Fed’s greatest frustration…{snip}

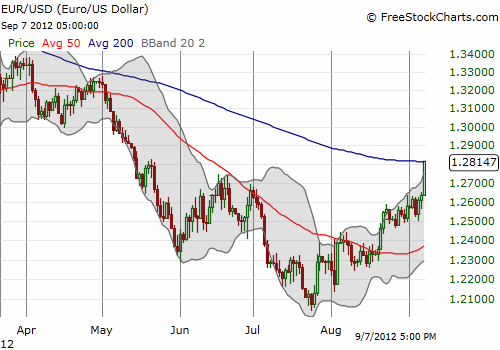

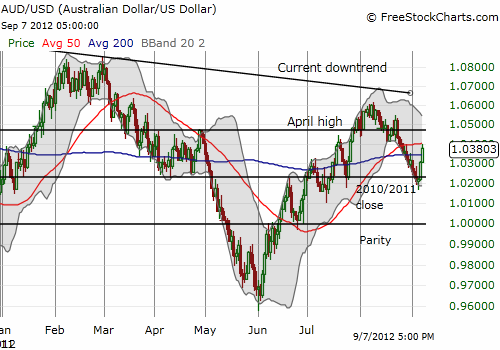

Now working in the Fed’s favor is the recent drop in the dollar (UUP)…{snip}

{snip}

{snip}

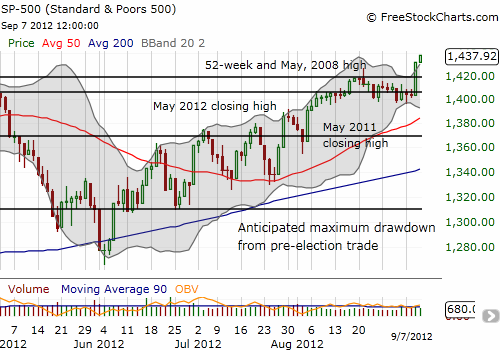

One of the oddities about the prospects for further monetary easing is that it might come at a time the stock market is doing just fine. {snip}

This is not a time to fight the Fed…{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 11, 2012. Click here to read the entire piece.)

Full disclosure: short EUR/USD, long GBP/USD, long GLD, SLV, and PAAS