(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are posted on twitter using the #120trade hashtag)

T2108 Status: 71.7% (fifth day of fifth overbought period since June 29)

VIX Status: 15.0

General (Short-term) Trading Call: Start or add to bearish position on lower S&P 500. Otherwise hold.

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar)

Commentary

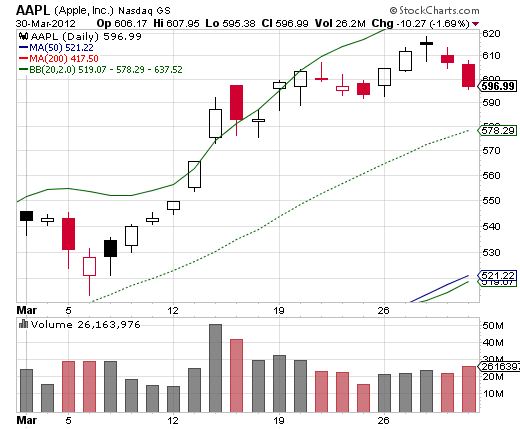

This picture should set off alarm bells with every and any technician paying attention:

This false breakout – where the S&P 500 surged to new 52-week and 4+ year highs only to close below the breakout point the same day – is a stark reminder of why traders wait for confirmation of major moves. Let the market prove that it is strong (or weak as the case may be). Now, this bearish pattern opens up the opportunity to go short with a tight stop at fresh highs. T2108 is still overbought, so I am well within the rules to initiate fresh bearish positions (with SSO puts). Moreover, stochastics are VERY overbought right now.

The day’s fade also produced similar fades across many individual stocks. Those that faded at recognizable resistance levels will be particularly vulnerable to swift selling as traders rush to take profits before they get taken away in September’s seasonal weakness.

Caterpillar (CAT), my canary in the coal mine, faded right at breakeven for the year. I consider this confirmation of the increased downside risk. CAT is also an example of a good (swing trade) shorting candidate: short on a break below Tuesday’s low and stop out, if needed, at the highs of Tuesday. An even better candidate would be a stock below BOTH its 50 and 200DMAs.

The strong relationship between the S&P 500 and the Australian dollar continued. I provide the details in a separate post: “From Bearish Divergence to Bearish Convergence.”

I also looked to Apple (AAPL) for clues given its strong and impressive breakout over the last two days. Today, Apple broke down along with the market, but it did NOT break the lows from Monday. While it broke out to new all-time highs only to fade backwards on high volume, it is a tad early to get bearish. In fact, Apple could actually represent a sliver of hope that buyers and bulls can collect themselves fast enough before this fade turns into a full-out correction. There is every possibility Tuesday’s pull back will be similar to March 15th’s pullback. At that time, it surely felt like Apple had finally topped out – exactly one month after Apple printed a classic topping pattern.

The next three important things to watch as signs of follow-through weakness: 1) first a break of Monday’s low, 2) then a break of the primary uptrend, 3) and finally a drop and a close BELOW the breakout point (around $636). If Apple retests the breakout point, I am expecting the line to survive the test.

Source: Stockcharts.com

Daily T2108 vs the S&P 500

Click chart for extended view with S&P 500 fully scaled vertically (updated at least once a week)

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long AAPL calls, long CAT