(This is an excerpt from an article I originally published on Seeking Alpha on August 6, 2012. Click here to read the entire piece.)

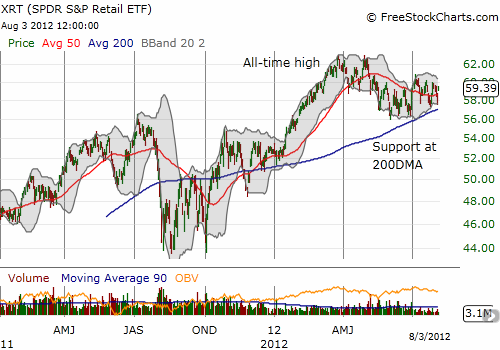

The HOLDRS Retail ETF (RTH) made new all-time highs in late July, and the SPDR S&P Retail ETF (XRT) has remained in a trading range since failing a retest of its all-time highs in late April.

While these strong performances represent hopeful signs for the consumer, I took great interest in the number of high-profile consumer/retail-related stocks that experienced awful performances in this summer’s earnings cycle. {snip}

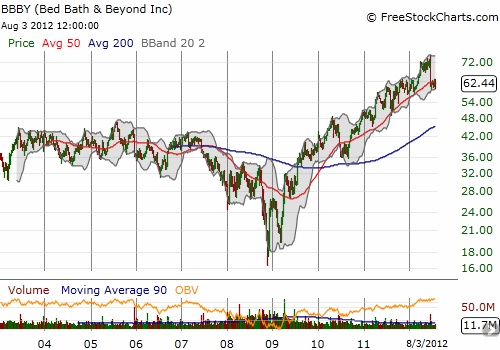

Bed, Bath and Beyond (BBBY)

BBBY initiated the series of high-flyer shockers with an unusual 17% post-earnings drop on June 21. Perhaps it was a sign and a warning. {snip}

Interestingly, the market was not consoled by BBBY’s insistence it would stick with is full-year guidance…{snip}

This disappointment represents the opportunity. The minute the market regains its confidence that BBBY will hit that target, the stock should begin its full recovery. In the meantime, BBBY has been a great range-bound trade whether you are bearish or bullish. {snip}

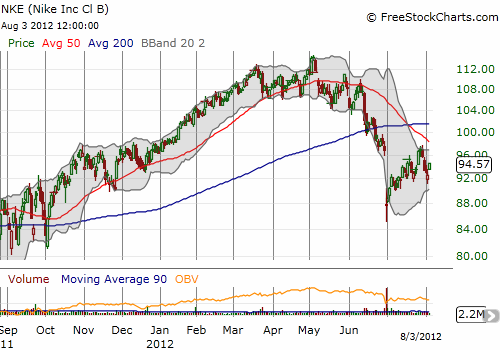

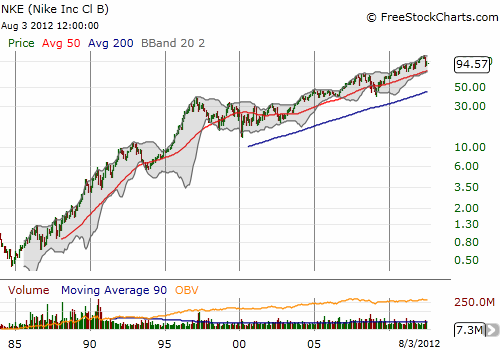

Nike (NKE)

When Nike stunk up the joint a little over a week after BBBY, I think the market shifted into high alert on consumer-related stocks. {snip}

{snip}

{snip}

In the meantime, Nike is doing penance for the crime of an earnings decline – the company’s first since 2009…{snip}

I am sure cautious commentary on China further hurt sentiment:

{snip}

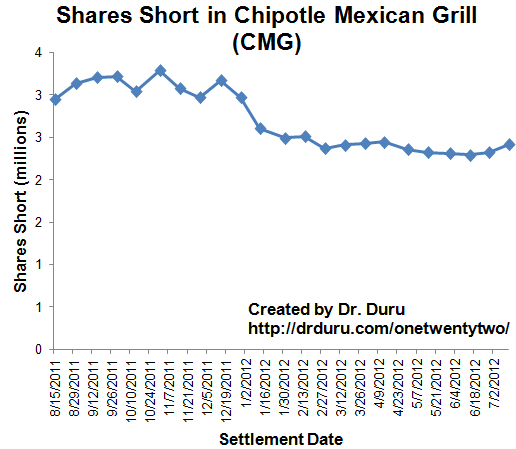

Chipotle Mexican Grill (CMG)

{snip}

{snip}

CMG’s crime? Rising food costs (especially thanks to the drought), falling same store sales, and looming competition from Yum!’s Cantina Bell (see “Chipotle Due For A Serious Correction: Part II” for more details)… {snip}

Source: NASDAQ short interest

Starbucks (SBUX)

{snip}

The crime? SBUX guided Q4 AND fiscal-year 2013 earnings below consensus despite reporting an eleventh consecutive record quarter for earnings in its third quarter. SBUX openly talked about economic headwinds as it described the aggressive steps it will take to “navigate” the storm…. {snip}

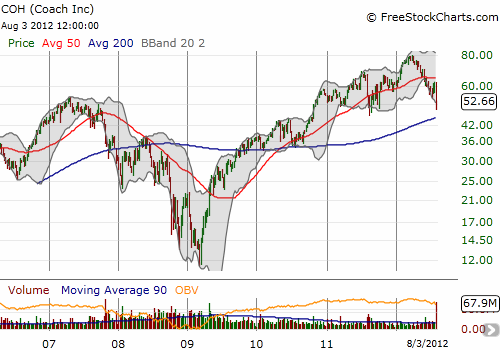

Coach (COH)

{snip}

While COH is a well-managed, international business, it is not immune to macro-economic issues. As the chart above shows, COH peaked ahead of the last recession in April, 2007. This top occurred six months before the S&P 500 peaked for the last bull market. I am guessing that now anytime COH speaks about macro-economic issues, the market pays very close attention. {snip}

The crime? COH reported same-store sales growth in the U.S. of 1.7% down significantly from the 10% a year ago. A “promotional environment” in North America slowed growth in factory stores and forced COH to fight back with its own increase in couponing. This promotional environment will extend into the guidance period:

{snip}

Despite these warnings, I do not see anything fundamentally wrong with COH’s business. {snip}

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on August 6, 2012. Click here to read the entire piece.)

Full disclosure: long calls in SBUX, CMG; long SBUX puts; short NKE; long AMZN